COP26: What developing countries need to fight the climate crisis

Will COP26 be a lost opportunity? Or will world leaders deliver a finance package that helps developing countries meet or even exceed their current climate targets?

As world leaders gather in Glasgow on Sunday to debate how to keep the planet in a livable condition, one critical bone of contention between more mature economies and developing ones continues to be how to fund the battle against the climate crisis.

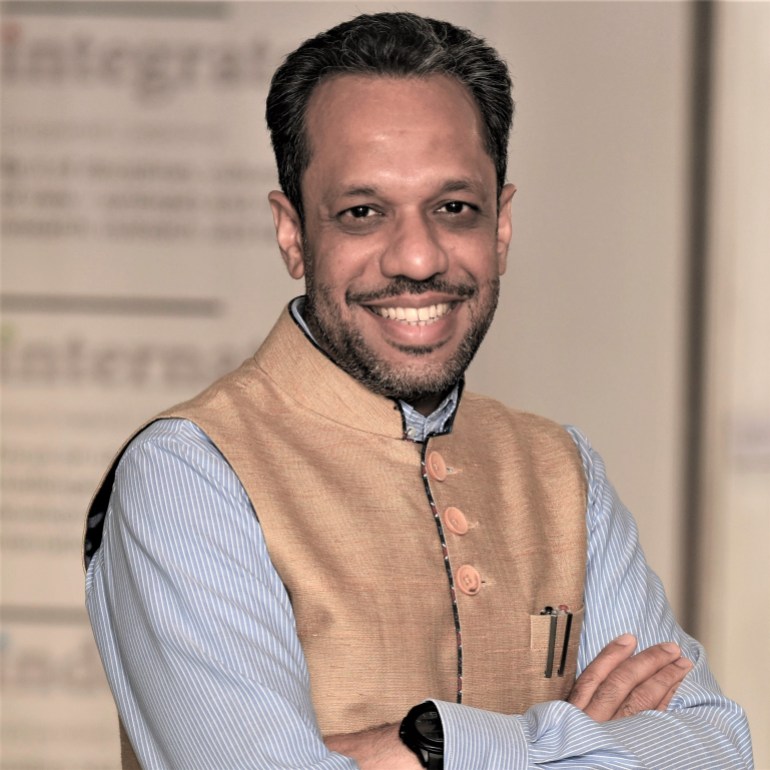

Al Jazeera Senior Business Producer Megha Bahree dug into that question with Arunabha Ghosh, founder and chief executive of the New Delhi-based Council on Energy, Environment, and Water (CEEW), one of Asia’s leading policy research think-tanks.

Keep reading

list of 4 itemsUN chief warns world on ‘one-way ticket to disaster’ over climate

Forests, fire, fuel: Climate battles on Europe’s front line

Majority in US concerned about climate, blame oil firms: polls

Ghosh discussed the wide chasm between richer and poorer nations, the need to get a whole lot more ambitious with current net-zero targets, and even laid out some pragmatic solutions to help developing countries secure the funding they need to deliver on climate goals.

This interview has been edited for clarity and length.

Megha Bahree: What is the objective of the upcoming United Nations Climate Change Conference (COP26)? And what are the different negotiating stances?

Arunabha Ghosh: The most important objective for COP26 is that it delivers the means by which countries can actually get to the [climate] targets they’ve set for themselves.

There is another objective here, which is to raise the ambition of what countries can do. These two objectives are projected by different groups of countries.

The developed world would want COP26 primarily to focus on delivering on the means by which existing commitments can be met. And herein lies the dilemma. Because while the planet has a single carbon budget, each country wants its fair share of it in order to be able to grow.

MB: Is the debate on what is the fair share?

AG: The debate is actually not even on that. The debate is on will you recognise that the planet is in peril and therefore raise your ambition, versus, will you recognise that the planet is in peril and therefore provide the finances for us to become more sustainable.

So, all parties recognise that the planet is in peril. But the solutions there are ranging from the here and now to the very long term.

MB: Can you lay out what the two positions are?

AG: One position is that the only way to keep the planet on a sustainable pathway, that is, have a chance of keeping temperatures within two degrees or to 1.5 degrees above pre-industrial levels, is that all countries now raise their ambition beyond what they had promised in 2015. And this raised ambition should include things like a target year for net-zero emissions and also what they would do in the near term.

The other narrative is that developing countries can only fulfil their ambitions if adequate investment and access to technology were available. Some of that funding has to come as grants. But what developing countries are also asking for is just real hard investment that comes into building the clean energy infrastructure that their economies need. And if that investment is not available, if the technologies are not accessible, if the rates of interest are too high, then promising higher ambitions is really a moot point, because you can keep saying things that you want to do without having the resources to do it.

MB: Is there a ballpark dollar amount on what resources are required? and for what purpose?

AG: One estimate is that the developing world needs somewhere in the order of about $3.5 trillion up to 2030 alone for reducing emissions, putting in renewable energy infrastructure and so forth. Each country comes up with its own calculations of how much is needed.

What is clearly evident is that the developed world’s promise — to pay 2010 onward to the developing countries an amount that was to be scaled up to annual flows of $100bn — has not only not been met, but it should be a floor and not a ceiling for the kind of climate finance that is needed.

MB: That’s quite alarming that there’s such a wide gap and there doesn’t seem to be a way to narrow it.

AG: Indeed. What has happened is we are trapped in what I call a negotiated maximum and a delivered minimum. So, we keep harping on that $100bn rather than thinking of what will be the innovative mechanisms by which that much larger amount of money can flow.

The cost of finance in emerging economies across the world is very high because investments in these areas are considered risky. Not because the technology is unknown. It’s the same solar panel in Norway as it is in New Delhi. But investors think that putting up renewable energy or electric mobility or energy efficiency in industry projects in developing countries will face all sorts of risks, including currency, political, policy and so forth.

And if you were to try and hedge all of that, the cost of finance becomes exceedingly high. So, you need an international mechanism that manages to de-risk the investments.

MB: How does that work?

AG: The idea here is that you create a pooled fund that would manage to offer a first-loss guarantee against the risks associated with the currency fluctuations or a political or a policy change over which a project developer has no control.

Then your cost of finance comes down, and then your tariff for solar power or battery storage or electric mobility comes down. That allows for international institutional investors also to come into emerging markets and provide a large volume of capital.

MB: What you’ve just explained sounds pretty straightforward — that you take care of this one problem and that should open the floodgates. Why is this not happening?

AG: There are two reasons for this. One is an emerging economy blind spot within the institutional investors because most of them, whether they are pension funds sitting in Norway or pension funds sitting in California, they’re basically looking at investing in their home countries or in regions that they are familiar with even though 88 percent of new demand in electricity over the next two decades will come from the emerging markets.

The second reason is that while multilateral financial institutions have offered some de-risking solutions in the past, they have done that in country-specific contexts and they aren’t looking across countries.

MB: You work with governments across the world. What do they say when you suggest this idea? Is this not of interest?

AG: The short answer is it is of interest, and we’ve had a version of the common risk mitigation mechanism that was formally endorsed by President Macron [France] and Prime Minister Modi [India] and President Kagame of Rwanda in 2018. And there is a realisation that something fundamentally different has to happen on de-risking. And yet, we need a political first mover, or a set of political first movers. Until the political signal comes for this, the technocratic wheels don’t begin to turn.

MB: What are they waiting for?

AG: I think this goes back to the fundamental variation of the objectives of COP26 as I laid out at the outset. Because if you are basically coming from the camp that says the only way to save the planet is to raise ambition, then you’re not thinking about how you meet that ambition. Versus, if you’re coming from the camp that says the only way to save the planet is to get money, then you’re focused on that $100bn marker rather than thinking about what will it take to get a much larger pool of money coming into these. So as a result, the more pragmatic responses to this challenge are falling between the gap between these two different political narratives.

MB: What is your expectation of this COP26?

AG: I like to call it a wish list.

Number one, I want developed countries to say that we’ll get to net-zero emissions well before 2050. Because if the planet has to get to net-zero in 2050, then developed countries can’t be getting to net-zero in 2050 as well, as in that case the law of averages will not work and then everybody has to get to net-zero in 2050. That’s like saying everyone wins the marathon exactly at the same time.

Secondly, this $100bn has to be treated as a floor, not a ceiling. And there should be some sort of a mechanism to ratchet up the public funds associated with this in the coming years.

Third, we need a deal on finance that focuses on de-risking, because otherwise, you will never get that large volume of institutional capital that is needed to bend the curve.

Fourth, we need some sort of an insurance cushion against climate shocks. Because today, if a single-year pandemic can send 100 million people back into poverty, climate risks are going to be compounding year upon year upon year. And the poorest communities in the poorest countries don’t have anything to fall back on. And when a perfect storm of shocks hits, you have a public health shock and then you have a food shock and you have a natural disaster shock, you can’t expect a sub-Saharan African country to suddenly cough up all that money from its fiscal reserves which are non-existent. I call it a global resilience reserve fund to pay out to bolster the fiscal reserves of countries that are getting hit by shocks that they never did anything to create.

And finally, we need a very different way of thinking about technology. For instance, if you look at something like hydrogen, a lot of the research on it is happening in Europe. However, much of the demand is going to come from Asia. But Asian countries are almost completely missing from any kind of hydrogen-related technology partnerships. We need to bring together the tech developers and the markets.

Similarly, when we think of the technologies that are cheaper, that are directed for the poor, we don’t have mechanisms by which you can lower the cost of a solar-powered textile unit, or a solar-powered flour mill or a solar-powered irrigation pump. The market opportunity for these is in the tens of billions of dollars. In India alone, distributed energy can power livelihoods in a market size of $53bn in rural areas. In sub-Saharan Africa, solar irrigation alone is a nearly $12bn opportunity. But for it to take off you have to make working capital and consumer finance easily accessible to the small entrepreneurs, the small households in rural areas.

MB: What are the chances they’re going to see some of that?

AG: I am still hopeful that at least some elements of this kind of a deal, some of these packages can still be put together. But it is also possible that everyone will dig their heels in and then, of course, it’s a lost opportunity.