India’s Future Group’s shares surge on suspension of Amazon deal

India’s antitrust regulator suspended Amazon’s deal with Future, allowing a deal with competitor Reliance to go ahead.

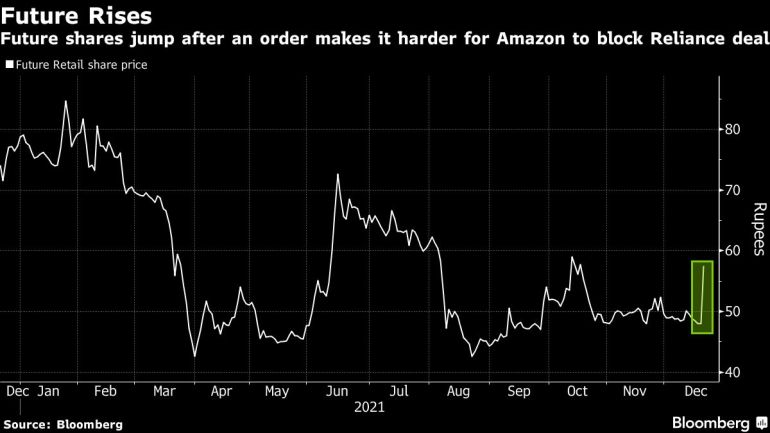

Shares of India’s Future Group companies have surged about 20 percent after the country’s antitrust agency suspended Amazon.com Inc’s 2019 deal with the group, potentially making it easier for Reliance Retail to buy Future’s retail business.

The shares soared on Monday after the regulator’s ruling on Friday that the US e-commerce giant suppressed information while seeking regulatory approval two years ago for its $200m investment in Future Group, India’s No 2 retailer.

Keep reading

list of 4 itemsIndian media tycoon battles to hold on to his empire

Amazon copied products, rigged search to push own brands: Reuters

Indian insider: Regulator bans tycoon from market for one year

Amazon has for months successfully used the terms of that deal to block Future’s attempts to sell retail assets for $3.4bn to a unit of Reliance Industries Ltd, Amazon’s biggest rival in the Indian retail space.

The Competition Commission of India (CCI) said Amazon will be given time to submit the information again to seek approvals, but a person with direct knowledge of the matter told the Reuters news agency that Future was unlikely to cooperate with Amazon if it tries to reapply for antitrust clearance.

Amazon, Reliance and Future did not immediately respond to Reuters requests for comment on Monday. Amazon had said on Friday it was reviewing the order “and will decide on its next steps in due course.”

Amazon is likely to challenge the ruling in the coming days, people familiar with the matter said.

“Investors in Future have a morale booster now. With CCI getting into the matter, there is a strong indication that Future’s deal with Reliance may go through with fewer troubles, even though some challenges may be brought forward,” said Gaurav Garg, the head of research at CapitalVia Global Research.

Saloni Nangia, the president of retail consultancy Technopak told Al Jazeera that the move is not likely to affect foreign investor interest in India’s retail sector. “There is a lot of interest in the Indian market consumption story which will continue,” she said adding, “These are based on the core fundamentals of the Indian economy and market and we do not see this changing for some time to come.”

Future Retail, Future Consumer, Future Enterprises and Future Lifestyle Fashions climbed nearly 20 percent.

Reliance Industries shares slid 2.7 percent amid a broader market selloff.

Future Retail shares had surged after its Reliance deal was announced in August last year, but have lost around a third of their value as Amazon mounted challenges.