OPEC+ plans major oil production cut despite US pressure

OPEC+ producers expected to agree to deep cut in their output target, curbing supply in already tight market despite US pressure to pump more.

The OPEC+ alliance looks set to make deep cuts in the amount of oil it ships to the global economy, which would reduce supply in an already tight market, despite pressure from the United States and other countries to pump more.

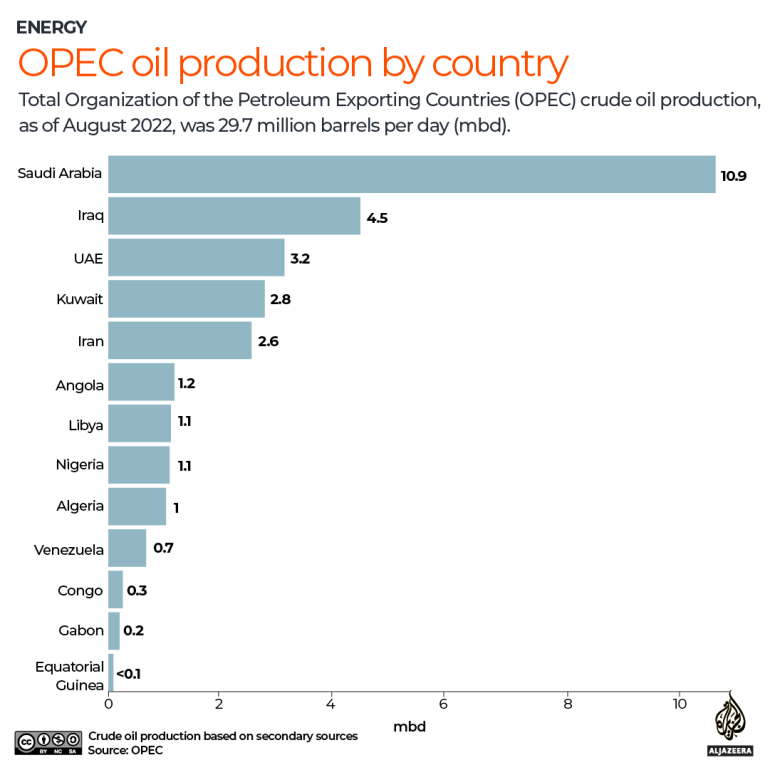

Energy ministers from the OPEC cartel, whose leading member is Saudi Arabia, and allied non-members, including Russia, are meeting in person at the group’s Vienna headquarters on Wednesday for the first time since the start of the COVID-19 pandemic in early 2020.

Keep reading

list of 3 itemsOPEC+ answers Biden’s diplomacy with tiny oil-output hike

Oil prices jump as OPEC+ agrees to small output cut

The potential cuts could help Russia weather a looming European ban on its oil exports by forcing oil prices up. They’ve dropped to about $90 a barrel from $120 three months ago due to fears of a global recession.

OPEC+ is considering cuts of one million to two million barrels per day, sources told Reuters, with several sources saying cuts could be closer to two million.

Such a production cut “would undoubtedly signal to the market the determination and resolve of the cartel to support oil prices,” UniCredit economist Edoardo Campanella said. But supply would drop by less than announced.

“If the group cuts target production by 1 million barrels per day, actual output would likely drop by about 550,000 barrels per day as countries like Russia or Nigeria that are producing below quota would see their formal target decline but remaining above what they can currently produce,” Campanella said.

The US is pushing OPEC not to proceed with the cuts, arguing that fundamentals don’t support them, a source familiar with the matter said. The White House wants to avoid an increase in petrol prices for US drivers just ahead of congressional elections in November.

It’s unclear how much impact a production cut would have on oil prices because members are already unable to meet the quotas set by OPEC+. Yet Saudi Arabia might be unwilling to strain its relationship with Russia even if the world’s largest oil exporter had any reservations about cutbacks.

The looming OPEC decision has recently drawn leaders from US President Joe Biden to German Chancellor Olaf Scholz to talk about energy supplies.

Washington reaction

The White House declined to comment before OPEC makes a final decision on oil production, but Press Secretary Karine Jean-Pierre told reporters on Tuesday that the US would not extend releases from its strategic reserve to increase global supplies.

Biden has tried to claim credit for petrol prices falling from their average June peak of $5.02 a gallon ($1.33 a litre). Officials from his administration highlighted a late March announcement that a million barrels a day would be released from the strategic reserve for six months.

But Citigroup analysts said that higher oil prices, if driven by sizeable production cuts, would likely irritate the Biden administration ahead of US elections.

“There could be further political reactions from the US, including additional releases of strategic stocks along with some wild cards, including further fostering of a NOPEC bill,” the bank said, referring to a US anti-trust bill against OPEC.

JPMorgan Chase said it expected Washington to put in place countermeasures by releasing more oil stocks.

Saudi Arabia and other members of OPEC+ have said they seek to prevent volatility rather than to target a particular oil price.

Benchmark Brent crude traded flat at below $92 per barrel on Wednesday after rising on Tuesday.

The West has accused Russia of weaponising energy and creating a crisis in Europe that could trigger gas and power rationing this winter.

Moscow accuses the West of weaponising the dollar and financial systems such as SWIFT in retaliation for Russia sending troops into Ukraine in February.

Part of the reason Washington wants lower oil prices is to deprive Moscow of oil revenue. Saudi Arabia, however, has not condemned Moscow’s actions.

Relations have been strained between the kingdom and the US government. Biden travelled to Riyadh this year but failed to secure any firm commitments on energy. cooperation

“The decision is technical, not political,” United Arab Emirates Energy Minister Suhail al-Mazroui told reporters.

“We will not use it [OPEC+] as a political organisation,” he said, adding that concerns about a global recession would be one of the key topics at Wednesday’s meeting.