Why is OPEC+ cutting oil production and what’s next?

The move comes ahead of the European Union embargoes on Russian energy over the Ukraine war.

Global oil supply is set to tighten, intensifying concerns over soaring inflation after the OPEC+ group of nations announced its largest supply cut since 2020.

The move comes ahead of European Union embargoes on Russian energy over the Ukraine war.

Keep reading

list of 3 itemsEuropean leaders gather in Prague, Russia not invited

Oil soars as OPEC+ mulls largest output cut since 2020

Here is what we know:

What has OPEC decided and why?

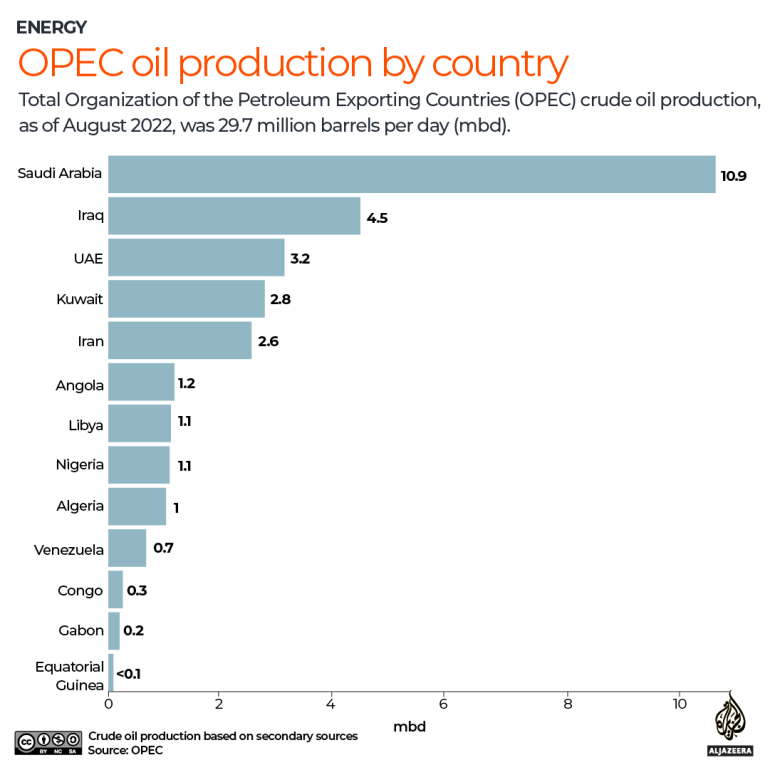

The Organization of the Petroleum Exporting Countries (OPEC) and their allies, including Russia, on Wednesday agreed to slash output by two million barrels per day (bpd) just ahead of the peak winter season.

The OPEC+ member states cut production starting in November after gathering for their first face-to-face meeting at their Vienna headquarters since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economy and oil market outlooks”. Saudi Arabia’s energy minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Abdulaziz bin Salman said the real supply cut would be about 1 million to 1.1 million bpd, a response to rising global interest rates and a weakening world economy.

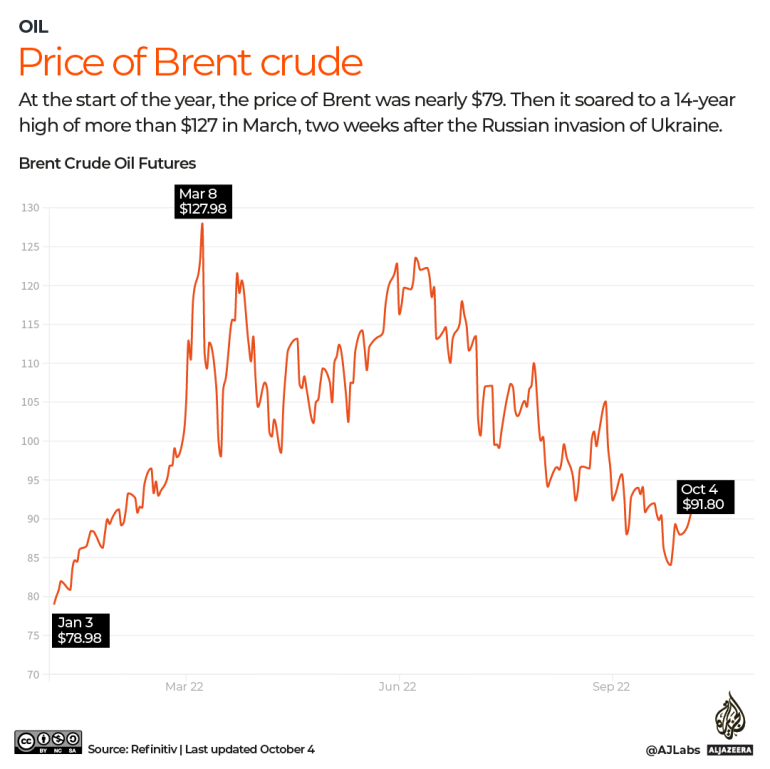

After the announcement, the price of Brent crude, the international benchmark, rose 1.7 percent, reaching $93.29 a barrel.

At the start of the year, Brent prices were close to $79 a barrel. It soared above $127 in March, two weeks after the Russian invasion of Ukraine – the highest in 14 years.

At the beginning of this week, Brent levels were at $88.86, with prices steadily falling in the past month over fears of a global recession.

Higher oil prices and a strong US dollar could represent a difficult situation as most countries buy their oil using dollars. The move could increase inflation and the cost of living.

What comes next?

Swissquote analyst Ipek Ozkardeskaya warned the big cut could “backfire” on OPEC+ if investors fear it will push inflation higher and force central banks to hike interest rates so much that it triggers a recession.

“The higher the energy prices, the sharper the central banks must kill demand to pull the prices lower,” she said before the decision was announced.

The move could also put regions like Europe in a difficult position. Many European nations have imposed a price cap on Russian oil, but Putin has said Russia will withhold exports to countries that enforce the cap.

According to an analysis by the Financial Times, OPEC’s cuts could coincide with further falls in supply. Also, the move could hinder efforts to deprive Moscow of oil revenue following Russia’s invasion of Ukraine.

Professor Adam Pankratz, professor at the University of British Columbia’s Sauder School of Business, told Al Jazeera the price of oil will probably go up with the cut and oil is “going to be a scarce commodity”.

“That starts creating larger problems in terms of environmental policy for Europe. Should you be drilling for your oil? I don’t know, and they probably won’t, at least initially. But that is a realistic thing to ask,” he said.

Analysts also warned against complacency over high European gas stores, which are nearly 90 percent full.

“With Europe’s winter season now in sight, gas markets are snug but by no means cosy,” Rystad Energy analyst Emily McClain said in a market note.

An early or extended winter could send gas stocks downward, pushing prices higher, she added.

The move by OPEC+ also prompted warnings from oil-importing emerging markets, some of which have become particularly vulnerable to price shocks amid recent global supply snags.

Sri Lanka is battling its worst economic crisis since its independence from Britain in 1948, with a plunge in its currency, runaway inflation and an acute dollar shortage to pay for essential imports of food, fuel and medicine.

President Ranil Wickremesinghe warned that Sri Lanka will have to pay even more for fuel as richer countries stock up for their own needs.

“This is not just an issue faced by us but several other South Asian countries,” he told parliament on Thursday. “Global inflation is going to hit us all next year.”

How has the world reacted?

That move triggered a sharp response from Washington, which criticised the OPEC+ deal as shortsighted.

The White House said US President Joe Biden would continue to assess whether to release further strategic oil stocks to lower prices.

“Saudi, UAE (the United Arab Emirates) and Kuwait are likely to take up most of the burden of cuts,” Tilak Doshi, managing director of Doshi Consulting, who was previously with Saudi Aramco, told Reuters.

“It’s a slap on Biden’s face by OPEC+,” he said, adding that ties between Russia and Saudi Arabia seem increasingly tight.