After the EU’s Russia coal ban, Germany grapples with oil and gas

The bloc took action after alleged atrocities in Ukraine, but analysts say a ban on oil and gas poses more complex challenges.

Berlin, Germany – Some German power plant operators had been preparing for sanctions announced last week for several months already. It was because of suspicious Russian behaviour, they said.

Late on the evening of April 7, the European Union announced a fifth packet of sanctions against Russia because of its invasion of Ukraine. Besides sanctioning individuals and restricting shipping, the EU’s packet included a ban on Russian coal imports from August onwards.

Keep reading

list of 4 itemsEU proposes ban on Russian coal imports after atrocities

Asia’s coal price jumps as EU’s Russia ban threatens supply

Japan plans to gradually reduce coal imports from Russia

“But we had actually been seeing delays in Russian coal deliveries since last September,” Alexander Bethe, chairperson of the German Association of Coal Importers, admitted on Friday.

His industry association, also known as the VDKi, represents the interests of the imported hard coal market there.

“First we thought it was due to COVID-19,” he told Al Jazeera. “That’s what our Russian partners told us.”

“Then,” added Stephan Riezler, a senior manager at STEAG Group, one of the largest power producers in Germany, “we started seeing pictures of the military build-up on Ukraine’s borders.”

And so some German coal importing companies started searching for alternative suppliers weeks ago.

Last week, a poll of VDKi members found that 79 percent say they would be able to manage without Russian coal.

Last year, Germany imported 41.1 million tons (37 million tonnes) of coal, according to the VDKi.

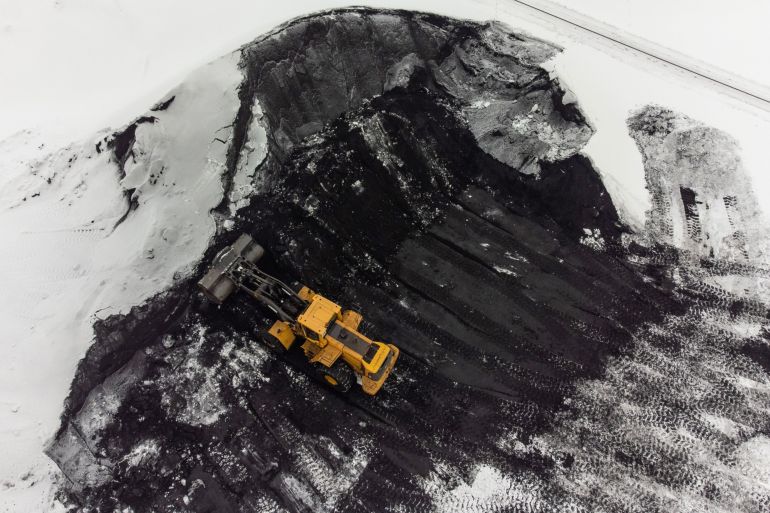

About half of the country’s hard coal (used for heating) and three-quarters of its steam coal (used for power production) come from Russia. In 2021, Germany paid Russia about 2.2 billion euros ($2.4bn). In total, Europe buys about 8 billion euros ($8bn) worth of coal from Russia annually.

Most of that will now be replaced by shipments from other countries such as Australia, South Africa and Indonesia. There will be higher prices and logistical hassles but coal from Russia could be replaced within a matter of months, a statement by the VDKi noted earlier in March.

But banning Russian coal is viewed as the easiest of the EU’s options on energy sanctions.

Although this fifth round of measures has broken a previous taboo around Russian energy bans, it has also come in for criticism – mainly because it does not touch upon the far larger quantities of gas and oil coming from Russia.

Europe buys about 20 million euros ($21.84m) worth of coal from Russia daily, but spends a further 850 million euros ($928m) a day on Russian oil and gas.

The EU has paid Russia 35 billion euros ($38bn) billion for energy since the beginning of the war and has only given 1 billion euros ($1.09bn) to fund Ukraine’s defence, Europe’s top diplomat Josep Borrell said last week.

Sooner or later, buying Russian oil and gas “will become morally and politically unjustifiable”, Piotr Buras, head of the European Council on Foreign Relations’ Polish office, wrote in an editorial last month.

The German government is in a particularly difficult position when it comes to banning Russian energy imports. Along with several other EU countries, including Hungary and Austria, Germany has been hesitant about imposing a total embargo.

Russian coal makes up about 4.5 percent of Germany’s primary energy inputs, Russian oil about 10.5 percent and Russian gas about 15 percent.

The German government has confirmed its willingness to phase out Russian energy altogether, but it might take a while, the federal economy ministry said in a statement last month.

By autumn, Germany says it wants to have done away with all Russian coal exports and by the end of this year, it will not be importing Russian oil any more; the EU has said it will look at restrictions on Russian oil next.

However, freedom from Russian gas will likely take until mid-2024. Unlike coal or oil, which can be shipped easily, it is harder to reroute natural gas.

“Gas cannot be substituted in the short term,” Germany’s finance minister Christian Lindner said recently. “We would inflict more damage on ourselves than on them.”

“It is still too early for an energy embargo,” the country’s economics minister, Robert Habeck, explained. “The economic and social consequences would still be too severe.”

How severe depends on who you talk to.

Over the past few weeks, there has been feverish debate in Germany about how much damage moving more quickly towards a total embargo could be seen.

German industry organisations and some of the largest companies in the world, like chemical firm BASF and engineering company Siemens, who are major users of Russian natural gas, have warned of “dramatic consequences” of a gas ban. There is the potential for tens of thousands of job losses and having to halt production, they say.

On the other side of the debate, local and foreign economic experts have suggested that, although Germans would face a recession in the event of a partial or total embargo, it would not be any worse than the first year of the COVID-9 pandemic. In 2020, Germany’s national income, or GDP, fell 4.5 percent.

The German economy would adapt, researchers behind one of those studies, a March policy brief produced jointly by the universities of Bonn and Cologne, argued.

“Whether you consider this new [fifth] package of sanctions good or bad, is a political judgement,” Moritz Kuhn, an economics professor at the University of Bonn and one of the co-authors of the brief, told Al Jazeera. “But from the point of view of economic impacts, I would say it [an energy embargo] is manageable.”

Even if there was an embargo tomorrow, Russia’s economy would not be immediately impacted, Simone Tagliapietra, a senior fellow at Brussels-based energy think-tank, Bruegel, pointed out, suggesting it would take several months for the ban to be felt.

There have been other more subtle suggestions made on countering European dependency on Russian energy. That includes an escrow account that withholds profits from Russia, or the setting of a high tariff on Russian energy imports. Working to reduce demand is also important, Tagliapietra added.

The German government is currently promoting energy-saving advice to households, noting that a fifth of gas demand could be reduced simply by changing habits.

A poll published in mid-March reported that 44 percent of Germans believed an immediate ban on Russian energy imports was a good idea. That feeling has grown, as more harrowing evidence of Russian war crimes emerged. More recently, 50 percent felt that way.

And really, that is “the ultimate question,” Tagliapietra told Al Jazeera. “How much are we willing to pay in order to seriously punish aggressions of the sort we are seeing? I think momentum is growing. But we need to be ready to pay the price.”