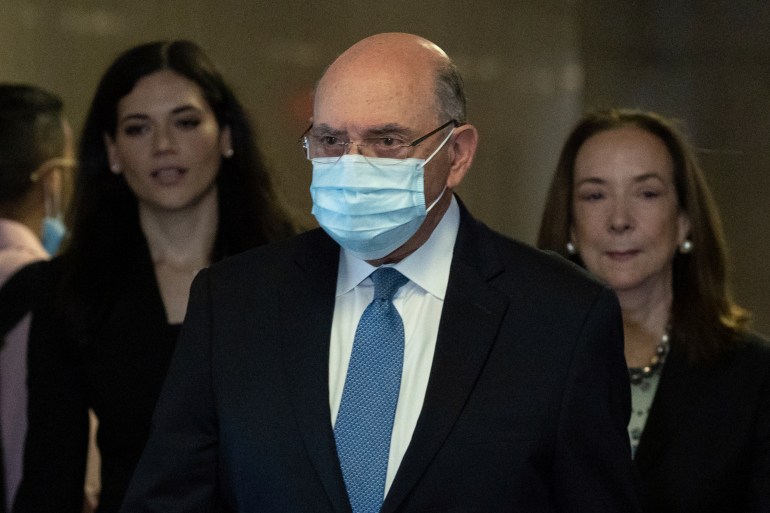

Trump executive Weisselberg pleads guilty to tax fraud

Weissellberg has spent decades at the Trump Organization, his plea deal may compel him totestify against the company.

The former chief financial officer of Donald Trump’s company, Allen Weisselberg, has pleaded guilty to tax violations in a deal that would require him to testify about illicit business practices at the Trump Organization.

Weisselberg entered guilty pleas to every one of 15 felony charges in a New York court on Thursday, before Justice Juan Merchan.

Keep reading

list of 4 itemsUS Justice Dept opposes efforts to unseal Trump search affidavit

Why did Trump endorse the Democrat who led the impeachment probe?

Espionage, affidavits, passports: What’s new in US probe of Trump

He had been charged with accepting more than $1.7m in off-the-books compensation from the former president’s company across 15 years, including untaxed perks like rent, car payments and school tuition.

Merchan asked Weisselberg in court Thursday if he had deliberately avoided taxes on those perks. “Yes, your honour,” Weisselberg answered.

Merchan agreed to sentence Weisselberg to five months incarceration at New York City’s Rikers Island jail complex, although he will be eligible for release much earlier if he behaves well behind bars.

That is far shorter than the many years in state prison he could have faced if, rather than plead guilty, he were convicted at trial.

The judge said Weisselberg will have to pay nearly $2m in taxes, penalties and interest.

The plea bargain also requires Weisselberg to testify truthfully as a prosecution witness when the Trump Organization goes on trial in October on related charges.

He is not expected to cooperate with Manhattan prosecutors in their larger probe into Trump himself, a person familiar with the matter told the Reuters news agency.

Trump has not been charged or accused of wrongdoing.

Despite Weisselberg’s refusal to cooperate, his plea will likely strengthen prosecutors’ case against Trump’s company, which has pleaded not guilty.

Weisselberg’s lawyer Nicholas Gravante Jr said his client pleaded guilty “to put an end to this case and the years-long legal and personal nightmares it has caused for him and his family”.

“We are glad to have this behind him,” the lawyer added.

The defendants were indicted in July 2021 on charges of scheming to defraud, tax fraud and falsifying business records, where some executives were paid “off-the-books”.

Prosecutors said Weisselberg concealed and avoided taxes on $1.76m of income including rent for a Manhattan apartment, lease payments for two Mercedes-Benz vehicles, and tuition for family members, with Trump signing the tuition checks.

Weisellberg surrendered to authorities and had pleaded “not guilty’ to the charges in July 2021.

Last Friday, Merchan denied defence motions to dismiss the indictment, rejecting arguments that the defendants had been “selectively prosecuted” and that Weisselberg was targeted because he would not turn on his longtime boss.

The Trump Organization manages golf clubs, hotels and other real estate around the world. It could face fines and other penalties if convicted at trial.

Jury selection begins on October 24, fifteen days before the November 8 midterm election, where Trump’s Republican Party hopes to recapture both houses of Congress from Democrats.

Trump has yet to say whether he plans another White House run in 2024.

Weisselberg has worked for Trump for about a half-century.

He gave up the CFO job after he and the Trump Organization were indicted in July 2021, but remains on Trump’s payroll as a senior adviser.

The indictment arose from an investigation by former Manhattan District Attorney Cyrus Vance, but lost steam after Bragg became district attorney in January.

Two prosecutors who had been leading the investigation resigned in February, with one saying felony charges should be brought against Trump, but that Bragg indicated he had doubts.

Trump faces many other legal battles.

Last week, FBI agents searched the former US president’s home for classified and other documents from his time in office.

Two days later, Trump was deposed in New York Attorney General Letitia James’s civil probe into his business but repeatedly refused to answer questions, citing his Fifth Amendment US Constitutional right against self-incrimination.