On rich, famous ‘cockroaches’ and tax evasion

Five years after the Panama Papers, the Pandora Papers are proof that hiding the money of the rich and powerful has only accelerated.

Rich, famous and infamous people who evade paying taxes are a lot like cockroaches – they can be lightning-quick and prefer to move about in the dark.

Reportedly, the rogue roster of rich, famous and infamous people who do not pay taxes includes fugitives, con artists, murderers, as well as kings, prime ministers, presidents, those who once were prime ministers or presidents, A-list actors, models, sports stars, and, of course, a bevy of cocky multi-millionaires and billionaires.

Keep reading

list of 4 itemsChile’s billionaire president under scrutiny over Pandora leak

Sri Lanka probes president’s niece over Pandora Papers claims

Ahead of election, Pandora Papers cast shadow over Czech PM

Quite the diverse, albeit content, company, eh?

The rich, famous and infamous are shown how and where to dodge paying taxes by other, cockroach-quick collaborators who also prefer, unsurprisingly, to move about in the dark.

These eager enablers are known – euphemistically – as lawyers, bankers and accountants. The rich, famous and infamous pay the lawyers, bankers and accountants a lot of money to devise ways to hide their wealth in dark places so they can pay little, if any, tax.

The byzantine ploys the lawyers, bankers and accountants come up with to hide their clients’ riches from the taxman or taxwoman are largely legal because on-the-take politicians write the “laws” to set up the “havens” in familiar and not-so-familiar capital cities to make certain their flush patrons – unlike you and I – do not pay taxes.

The rich, famous and infamous and their army of confederates believe – after the nanosecond they spend pondering the fate of working folks and the fast evaporating “common good” – that we are dupes. They mock us. They belittle us.

They mock and belittle us especially when some fool writes or says that “everyone must pay their fair share”. They know that has never happened and is unlikely to happen because there will always be one set of “rules” for the rich, famous and infamous, and a different set of “rules” for anonymous, tax-paying stiffs.

Still, every once in a while, journalists get their keen mitts on a bevy of financial documents that reveals what the rich, famous and infamous – with a little help from their scheming stable of lawyer, banker and accountant friends – have been up to lately in the dark.

In early October a peeved conspirator or co-conspirators – with that rare thing called a conscience – arranged to leak another batch of “secret” records to the International Consortium of Investigative Journalists (ICIJ) that detailed how the rich, famous and infamous have gone about hiding their millions and billions in new ways and stations.

When journalists turn on the lights from time to time the cockroaches – metaphorically speaking – have to scurry back into the darkness, as cockroaches are apt to do.

Like their money, they go into hiding (briefly) and trot out, instead, a loyal lawyer or “spokesperson” to say one of the following to defend stowing their loot in the usual tax “shelters” in the Caribbean, Europe or, more recently, in a slew of sympathetic US states like South Dakota for tax-free keeping.

Our client did not do anything illegal (True). Like a good, law-abiding citizen, they just followed the existing rules (Also, sadly, true).

Our client had to do what they did with their money to protect their privacy (Not true). The real crime is how these shady reporters have breached our client’s sacred privacy (Sort of true, but in the “public interest”). Our client did not know what their lawyers were doing with their money, but, it is all legal, anyway (Not true and true, respectively).

This time, scores of reporters – sifting through the data like prospectors looking for golden nuggets – dubbed the trove of leaked files the “Pandora Papers”.

The allusion to “Pandora” was meant, I suspect, to liken the reporters’ digging through the confidential information to opening a Pandora’s box to expose the truth.

The consortium disclosed to readers, viewers and listeners “the inner workings of a shadow economy that benefits the wealthy and well-connected at the expense of everyone else”.

That is simple, clear and, surely, accurate.

The ICIJ should be applauded for spending the time, energy and resources to name names and uncover how and where the rich, famous and infamous are socking away their fortunes with the ever agreeable aid of a worldwide gallery of reputable or disreputable banks and law firms – take your pick.

But here is the big problem with the ICIJ’s “unprecedented” revelations. These revelations are not that “unprecedented” at all.

In 2015, the German newspaper Süddeutsche Zeitung got hold of a huge cache of private financial records and shared it with the ICIJ. After a year-long investigation, they published the so-called Panama Papers which laid bare the same international cobweb-like network of banks and law firms that has permitted the rich, famous and infamous to keep much, if not all, of their dough and luxury properties safe from the taxwoman or taxman’s limp tentacles.

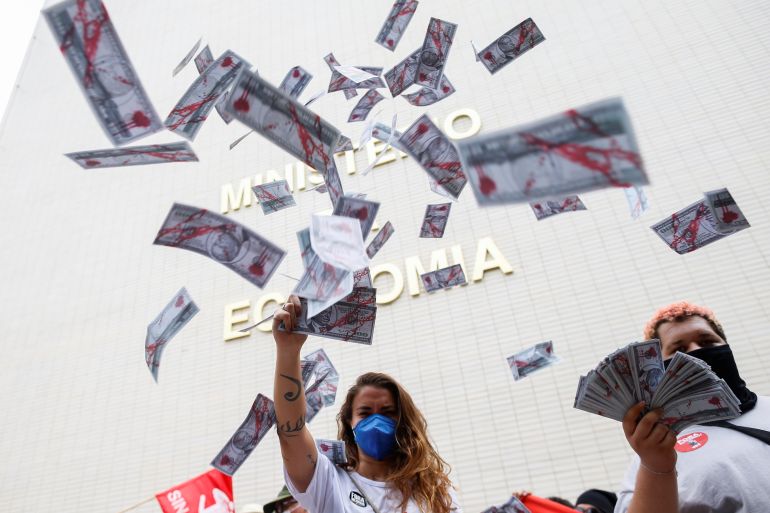

Sure, the Panama Papers disclosures made oodles of headlines and prompted outrage and protests decrying the unfairness of it all. A few governments hired more bureaucrats to try to find and recover a fraction of the estimated $11.2 trillion of hidden money. A couple of minnows in Malta and the United States were charged with tax fraud. And two Pollyannaish Democrats sponsored a piece of legislation in the US Congress – optimistically labelled the “Stop Tax Haven Abuse Act” – where it will, no doubt, die a swift and convincing death.

Meanwhile, the rich, famous and infamous keep skipping down the gilded road like happy, lollipop-sucking kids knowing that, beyond a passing burst of embarrassment, they enjoy lifetime immunity from any concrete consequences for their obscene greed and selfishness.

As Alex Cobham, an economist and chief executive of the Tax Justice Network, told the British newspaper, the Guardian, focusing scorn on the high-profile tax evaders misses the more urgent point.

“Few of the individuals had any role in turning the global tax system into an ATM for the super-rich. That honour goes to the professional enablers – banks, law firms and accountants – and the countries that facilitate them,” Cobham said.

In any event, five years after the Panama Papers, the Pandora Papers are proof that rather than making the rich, famous and infamous wary or even the slightest bit concerned, the profitable practice has, if anything, accelerated in scope as they have found other, perhaps more convenient homes, to stash their cash. (There will likely be future exposés.)

Couple this shameful, state-sanctioned tax-shirking racket with the accelerating, state-sanctioned chasm between the uber-rich and the rest of us – where the world’s wealth is being hoarded by a handful of recognisable names – and the perilous political reverberations are plain.

A parade of “populist” charlatans, with their distinct, dangerous, authoritarian dispositions and combustible hyperbole, have risen, yet again, from the swamp of ignorance and grievance to claim that they, and they alone, can unrig a rigged system they have exploited and that rewards the few at the expense of the many.

It is a lie. But it is an attractive and persuasive lie that is taking stubborn root and finding disquieting expression among the angry and alienated who gravitate towards these incendiary opportunists who, in turn, have leveraged that seething anger and alienation into power and influence.

The only way to sap the populist quacks of their allure and potency and to address seriously the, by now, risible myth that representative governments are made of the people, by the people, for the people is to take the belated, radical steps necessary to break, finally and firmly, the prevailing corporate hegemony that fuels the orgy of inequality.

Tinkering rhetorically around the polite, palatable edges will no longer do.

The views expressed in this article are the author’s own and do not necessarily reflect Al Jazeera’s editorial stance.