US economy turns in record Q3 growth, but crisis is not over

US GDP grows at a 33.1 percent annual rate in the third quarter, the fastest pace on record.

The United States economy grew at its fastest pace on record in the third quarter, rebounding at an annual rate of 33.1 percent, the Bureau of Economic Analysis said on Thursday.

The blockbuster reading follows on from a record-shattering 31.4 percent contraction in the second quarter – and a negative 5 percent hit in the first quarter – when the economy officially entered a recession in February.

Keep reading

list of 4 itemsMalaysia’s Anwar unveils record public pay hike amid ringgit’s slide

China’s revised state secrets law has come into force. Here’s what to know

In Japan, book criticising trans ‘craze’ sparks rare culture-war skirmish

The balance signals that though the economy is crawling out of the deep hole dug by COVID-19, it still has a way to go to recapture its pre-pandemic strength.

Put simply, the economic crisis is not over.

Moreover, some sectors of the economy are recovering faster than others and those disparities are rippling through the fabric of American society in the form of deepening inequalities.

Those with a job and assets like stock portfolios and homes are doing well, while those who are jobless or own a business ravaged by virus restrictions are falling further behind. Racial wealth and income disparities are widening. Women are dropping out of the workforce at an alarming rate as the demands of jobs and looking after children learning remotely force tough choices on parents.

Thursday’s gross domestic product (GDP) report is the last major economic data release before the November 3 US presidential election.

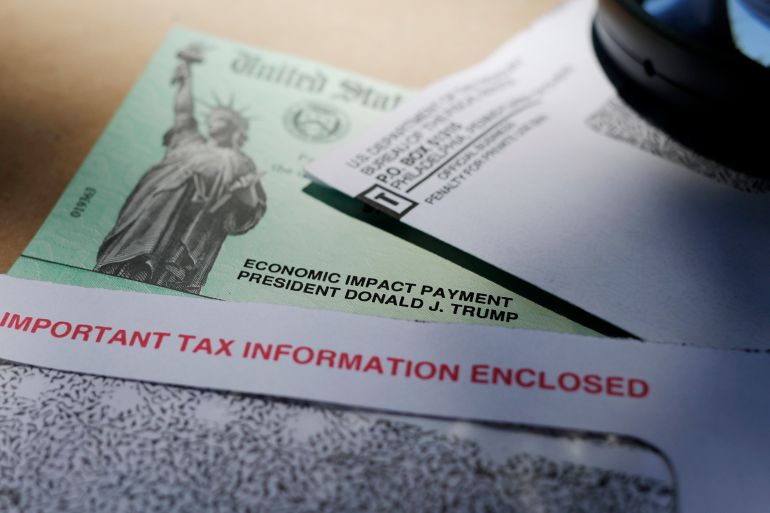

The headline figure was lauded by President Donald Trump, who tweeted on Thursday: “Biggest and Best in the History of our Country”, and warned that his Democratic rival Joe Biden would “kill it all” with tax increases.

GDP number just announced. Biggest and Best in the History of our Country, and not even close. Next year will be FANTASTIC!!! However, Sleepy Joe Biden and his proposed record setting tax increase, would kill it all. So glad this great GDP number came out before November 3rd.

— Donald J. Trump (@realDonaldTrump) October 29, 2020

But the report is unlikely to dramatically influence Trump’s re-election prospects, given that more than 78 million Americans have already voted, according to the US Elections Project.

But there is a world of uncertainty that lies ahead – both for the election and the economy.

If the results of the election are contested, it could lead to further hold-ups with a new round of virus relief aid as the White House and Democrats in Congress fail to find common ground.

The stakes could not be higher. Aid from the federal government such as enhanced employment benefits, lifelines for small businesses, and one-off cash payments to households helped the economy bounce back in the third quarter. But those stimulus effects are fading.

There is a mounting body of data that points to a downshifting recovery in the fourth quarter. Federal Reserve Chairman Jerome Powell has warned that more government spending is needed to keep the recovery on track.

Now surging COVID-19 infections are raising the spectre of more business-sapping restrictions.

An unprecedented recession, a slowing recovery

The COVID-19 recession is a far different beast from previous post-war contractions.

The Great Recession of 2008-2009 was triggered by a massive build-up of debt, mostly due to the housing bubble. When it burst, loans soured, house prices crashed, credit markets seized, wealth was wiped out, unemployment skyrocketed and demand for finished goods and services – what economists call “aggregate demand” – suffered a massive blow.

That devastated industries like construction and manufacturing and sent the Federal Reserve scrambling to create new tools to pull the US and global economies back from the brink of collapse. Congress dithered and eventually stepped up with a $787bn stimulus package in 2009.

But subsequent rounds of federal spending were not forthcoming, leaving the Fed to carry the recovery ball with the blunt tool of monetary policy. Many economists believe this led to a more protracted recovery.

The COVID-19 recession, by contrast, was triggered by lockdowns designed to contain the spread of the disease. Entire sectors of the economy ground to a halt virtually overnight, delivering an unprecedented supply shock that quickly turned into a demand shock as 22 million people were thrown out of work in March and April.

Customer-facing service industries, like restaurants, that employ a disproportionate number of low-wage workers, as well as minorities and women, were gutted.

This time around, the Fed acted much faster with bold and decisive action, such as slashing interest rates to near zero, resuming bond buying to keep borrowing costs at rock bottom and making trillions of dollars of lending available to keep credit markets from freaking out.

Congress also moved far more quickly on the spending front, approving some $3 trillion in virus relief aid to help small businesses keep workers on payrolls, laid-off workers remain afloat and state and local governments cope with the public health crisis.

The combined efforts of the Fed and Congress helped power the economy in the third quarter – putting money in people’s pockets to help unleash pent-up demand as lockdown restrictions were rolled back.

That is clear from Thursday’s numbers. Consumer spending – which drives roughly two-thirds of US economic growth – was indeed the hero of third-quarter GDP.

Businesses, such as car dealers building up inventories, exports and a red-hot housing market were also key drivers.

But federal stimulus programmes including the lifeline to small businesses and the $600 federal weekly top-up to state unemployment benefits expired at the end of July – and that waning stimulus is manifesting in metrics that signal the recovery is now shifting into low gear.

In August, personal income in the US declined 2.7 percent – a fall the US Department of Commerce said was “more than accounted for” by the expiration of the federal weekly jobless benefit supplement.

Disparities are also widening. Again – monetary policy is a blunt instrument.

While basement-level borrowing costs helped keep credit flowing to businesses and households – essential for keeping the economy healthy – they have also rewarded asset owners.

Record-low mortgage rates for example, helped drive sales of previously owned homes to a 14-year high in September, while investors chasing bigger returns from risker assets helped US stock indexes recover from the COVID crash earlier this year. The S&P 500 hit a new all-time high at the start of September.

That means many Americans who own their own home and are invested in the stock market and who still have a job are not only doing well, many of them are better off than before the pandemic.

Meanwhile, those who are out of work and who do not own appreciating assets are struggling.

Nearly one in three renters in the US did not pay their rent fully on time in the first week of October, while one in 10 started the month owing back rent, according to a housing payments survey by Apartment List.

Layoffs remain widespread. Some 751,000 Americans filed for state unemployment benefits last week. That is 40,000 fewer than the previous week, but still far above February’s average of just over 200,000 initial weekly jobless claims.

And though the nation’s unemployment rate fell to 7.9 percent in September – a little less than half of its pandemic high in April – it is still miles from February’s unemployment rate of 3.5 percent.

Only 11.4 million of the 22 million jobs lost during lockdowns have been recovered. Many temporary layoffs are turning into permanent job losses.

Federal Reserve chiefs are not exactly known for their plain-talking ways, but Powell was pretty blunt when he laid out the case earlier this month for more fiscal stimulus from Congress: “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” he said.

But more relief hinges on Congress and the White House overcoming their differences to pass another aid package.

Looming over this backdrop of partisan political acrimony is the ever-present threat of COVID-19.

Infections are surging in parts of the US, raising the spectre of more growth-sapping containment measures. In Europe, where cases are spiralling, France and Germany have ordered partial lockdowns.

The course of the virus, the outcome of the election and plateauing recovery are launching the US down an uncertain path. One that could lead to longer economic recovery.