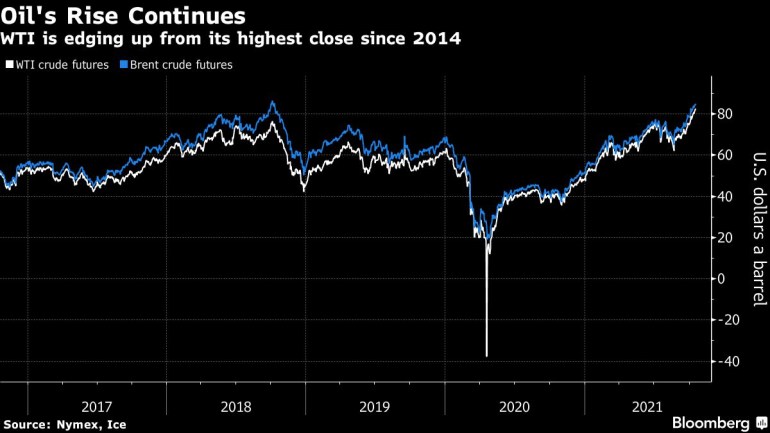

Brent crude closes above $85 a barrel for first time in 3 years

Meanwhile, United States benchmark crude closed at a fresh seven-year high.

The global benchmark Brent closed above $85 a barrel for the first time since October 2018 amid a stronger equity market and ongoing concerns around a worldwide energy crisis.

Brent crude futures eked out a 0.9% gain on Tuesday after a choppy session, while the U.S. benchmark crude closed at a fresh seven-year high. Risk-on sentiment prevailed in the broader markets as equities rose and the U.S. dollar weakened. Meanwhile, Russia signaled that it won’t go out of its way to offer European consumers extra gas to ease supply tightness unless it gets approval for a controversial pipeline.

Keep reading

list of 4 itemsOil surges to $80 a barrel as global energy crunch continues

US oil hits highest since 2014 as OPEC+ sticks to existing output

OPEC says oil will remain number one, despite green energy push

“Crude price volatility is here to stay as demand uncertainty remains elevated over the short-term,” said Ed Moya, senior market analyst at Oanda Corp. “There is a lot of noise in all this morning’s headlines, but given the relentless winning streak, oil prices are ripe for significant rounds of profit-taking.”

Crude has advanced for the past eight weeks as the energy crisis — prompted by shortages of natural gas and coal — coincided with a rebound in demand from key economies emerging from the pandemic. Russia indicated its keeping a tight grip on gas supplies to Europe and OPEC+ hasn’t pumped enough crude to meet its production targets, exacerbating a tight supply situation. It’s “possible” that oil will hit $100 a barrel this winter, according to commodities trader Mercuria Energy Group Ltd.

Prices

- West Texas Intermediate for November delivery rose 52 cents to settle at $82.96 a barrel in New York.

- Brent for December settlement advanced 75 cents to end the session at $85.08 a barrel.

In exchange for upping supplies, Russia wants to get German and European Union approval to begin using the Nord Stream 2 pipeline to Europe, according to people close to state-run gas giant Gazprom and the Kremlin. Gazprom PJSC’s gas exports to its main markets fell in the first two weeks of October to the lowest since at least 2014 for the time of year.

Technical indicators are showing that crude is in overbought territory. West Texas Intermediate’s 14-day Relative Strength Index is holding above 70, signaling oil may be due for a pullback.

Meanwhile, in the U.S., analysts surveyed by Bloomberg estimate a crude stockpile gain of 2.25 million barrels last week. The industry-funded American Petroleum Institute will release inventory data later Tuesday, while the U.S. government will release its weekly tally on Wednesday.

Other market news:

- Petroleo Brasileiro SA investors excluded from its $2.95 billion “carwash” corruption settlement in the U.S. are signing up for a class-action case in the Netherlands — where the Brazilian oil producer has failed to get the lawsuit thrown out on procedural grounds.

- Halliburton Co. failed to stoke investor enthusiasm with third-quarter results that merely met expectations after revenue took a hit from Hurricane Ida.