Virtual land and spaceships: NFTs and the new crypto frontier

A new twist on the American dream is taking root in virtual worlds, where investors buy parcels of land and strong communities boost desirability.

Since time immemorial, humans have fought over land — a scarce resource that determines where people can grow food, build houses and live out their days on planet Earth.

But only recently have the denizens of the internet begun fostering communities around the acquisition of virtual land that exists solely within fictional worlds created by video game developers.

Keep reading

list of 4 itemsNFT ‘self-portrait’ by Sophia the Robot sells for nearly $700,000

Power to the Beeple: Digital art fetches $69.3M at auction

Mysterious crypto investor Metakovan paid Ether in Beeple auction

The loneliness spawned by coronavirus pandemic restrictions has not just created the cultural space for meme-stock frenzies like GameStop — powered by retail investors. It is also inspiring gamers to spend more time and money playing in their favourite imagined realms, and it’s spurring speculators to capitalise on the expansion of blockchain technology into new terrain in the form of non-fungible tokens (NFTs).

NFTs are digital files underpinned by blockchain technology- the same technology on which popular cryptocurrencies like Bitcoin and Ethereum rest. But unlike crytpocurrencies, an NFT is totally unique and the blockchain ledger it sits on verifies who the rightful owner is of that unique asset.

That secure and incorruptible provenance means forgers can’t make a copy of an NFT and pass it off to some unsuspecting collector as the original. That proposition has gained serious traction this year.

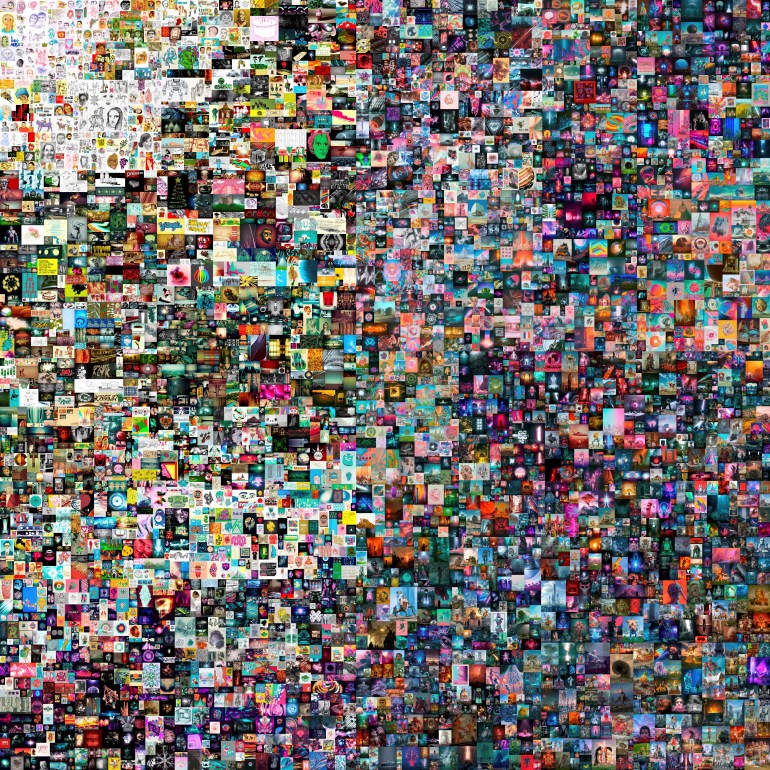

American artist Mike Winkelmann, who goes by the name Beeple, became one of the three most valued living artists in the world earlier this month when his NFT digital collage titled “Everydays – The First 5000 Days” sold at auction at Christie’s for $69.3m.

And it’s not just virtual artists who are reaping major paydays. NFTs have propelled prices for many virtual assets, such as sports memorabilia and even Twitter CEO Jack Dorsey’s first tweet, which sold at auction this week for $2.9m.

While the jury is out on whether investing in assets that only exist in the ether will prove prescient or deeply foolish, there is an undeniable zeitgeist surrounding maverick investors and their willingness to go where many portfolios have never gone before — so much so that some are banking that the appetite for digital land and other fantasy objects in virtual worlds will only grow.

Republic, an online investment platform for early-stage startups and crypto, plans to launch a series of digital real estate funds soon.

“On the heels of the GameStop saga, it has become apparent that retail investors have grown tired of operating within a financial system that favours the ultra-wealthy,” said Janine Yorio, head of real estate at Republic.

‘Pride of ownership’

With its verifiable property rights, Decentraland is the most developed and fastest-growing virtual land investment. With a vibe that feels like a combination of Second Life and SimCity, and similar to games such as Fortnite and Minecraft, Decentraland offers parcels that all must be bought and sold using MANA, its crypto token.

The market capitalisation of MANA was roughly $1.36bn around 9:00am ET on Friday, according to CoinMarketCap. The average price of a parcel of land in Decentraland over the past week was $1,653.64 compared to an all-time average of $393.22, according to NonFungible.com.

It’s not the only virtual land play. Somnium Space, Cryptovoxels, Axie Infinity and The Sandbox are among Decentraland’s competitors. Parcels are brought and sold on blockchain-based websites like OpenSea.io and NonFungible.com, where gamers, coders and everyone else can trade digital assets in crypto bazaars.

Like a physical homestead in the real world, investments don’t necessarily end with the initial land purchase. There is a sense of community in Decentraland where parcel owners help develop new features. Non-land owners are also welcome and have flocked to Decentraland’s wearables market, which features helmets, goggles, vests and pants.

Yorio believes young people are immersing themselves in such virtual experiences of the “metaverse” to create communities and fill real-world voids in social interactions and peer engagement.

“This pride of ownership is nothing new,” said Yorio. “In fact, owning land has always been the American dream. Now, this phenomenon is just playing out virtually.”

Far from alienating people from each other, NFTs can actually bring them together, says Scott Moore, a pixel art and open-source enthusiast at Gitcoin, a software pathway for developers.

“The point of tokenization isn’t to replace our need for connection, whether that’s with our friends, creators we care about, or otherwise, but to help strengthen those relationships,” he told Al Jazeera.

That connection is just about human need. It’s also good business, says Yorio, because the stronger the community, the more desirable the virtual land.

“Value in these virtual worlds is primarily based on public perception and [artificial] scarcity, which is why community is paramount here,” said Yorio.

Image is also important, she says, but especially in virtual realms where users are attracted to virtual land by an exciting game experience, compelling content or unique digital art.

‘Like buying Pokemon cards’ for retirement funds

Not all NFT fans are overly bullish on the market or utopian in their vision for it.

Some see the current craze as a natural evolution for millennials who are already very familiar with buying virtual goodies — and money — within video games.

“Cryptocurrencies and NFTs are just another new digital format to utilise,” said Samson Mow, chief strategy officer at Blockstream, a leading provider of blockchain technologies.

Mow, a Chinese-Canadian, is also the founder of Pixelmatic, the company behind Infinite Fleet — a massively multiplayer online (MMO) game that uses a crypto asset as the game’s currency. The company is currently doing a private security token offering (STO) while selling NFT spaceships.

Mow says that hundreds of spaceships have been purchased so far, with users intrigued by the novelty of playing with aesthetically attractive cosmic crafts. But even though he sells them, doesn’t recommend people buy them for investment purposes.

“People should only buy these things if they plan to use them in the game itself,” he told Al Jazeera. “Buying these things for investment purposes is like buying Pokemon cards for your retirement fund. Maybe one of them will become valuable one day, but more likely than not, it won’t.”

Mow also believes that the virtual property boom will pass, noting that that the desirability of many NFTs is often directly tied to the issuer’s reputation — such as the National Basketball Association’s backing of Top Shot NFTs.

Moore also cautions against an NFT market he describes as “frothy”. But he does believe the growing interest in NFTs points to a deeper, more lasting trend to democratise authority over virtual realms.

“We should be able to have more control over the spaces and platforms we interact with,” Moore told Al Jazeera. “Everything we have [online] — our identities, our media, our money — isn’t really ours.”