Inflation fears tamp down markets despite latest US stimulus

While the $1.9 trillion US stimulus package is expected to spur quicker global economic recovery, inflation fears persist.

Share markets turned mixed on Monday as the United States Senate passage of a $1.9 trillion stimulus bill augured well for faster global economic growth, but also put fresh pressure on Treasuries and tech stocks with lofty valuations.

The upbeat economic news continued with data showing that China’s exports surged 155 percent in February compared with a year earlier when much of the economy shut down to fight the coronavirus.

Keep reading

list of 4 itemsChina still 30 years from being a top manufacturer: Ex-minister

US urges IT network firms to secure controls after cyberattack

Key oil price surges above $70 after attack on Saudi facilities

“With the Senate’s passage, we expect growth momentum to accelerate and forecast global [gross domestic product] growth will surge to a 7.5 percent annualised rate in the middle quarters of the year,” said JPMorgan economists in a note.

“Every $1 trillion of fiscal stimulus adds around $4-$5 to [earnings per share], implying 6-7 percent upside for the remainder of the year.”

However, analysts also expected a sharp acceleration in inflation, stoked in part by the latest spike in oil prices, which was pushing up bond yields and making company share prices more expensive in relation to their underlying earnings, particularly in the high-tech space.

That saw US Nasdaq futures reverse early gains to slip 1.0 percent, dragging S&P 500 futures down 0.2 percent.

MSCI’s broadest index of Asia-Pacific shares outside Japan followed with a fall of 0.5 percent, while Chinese blue chips shed 0.9 percent.

Japan’s Nikkei clung to a gain of 0.2 percent, while EUROSTOXX 50 futures were still up 0.8 percent and FTSE futures 0.9 percent in late Asian, early European trade.

Equity investors had taken heart from US data showing nonfarm payrolls surged by 379,000 jobs last month, while the jobless rate dipped to 6.2 percent in a positive sign for incomes, spending and corporate earnings.

US Secretary of the Treasury Janet Yellen tried to counter inflation concerns by noting the true unemployment rate was nearer 10 percent and there was still plenty of slack in the labour market.

A supportive US money supply

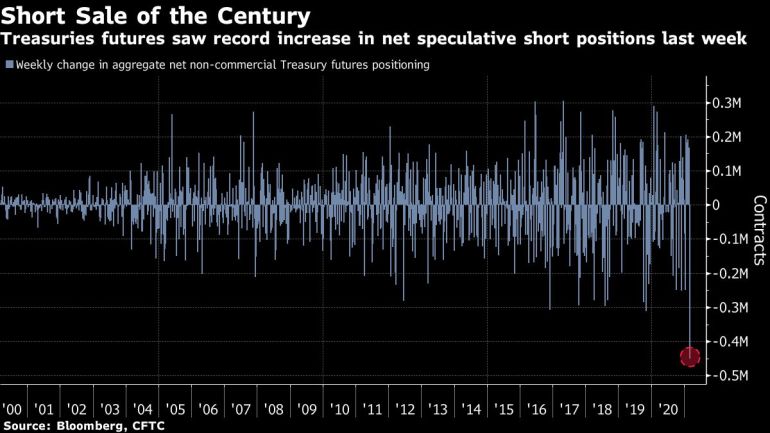

Yet yields on US 10-year Treasuries still hit a one-year high of 1.625 percent in the wake of the data and stood at 1.59 percent on Monday. Yields increased by a hefty 16 basis points for the week, while German yields dipped 4 basis points.

The European Central Bank meets on Thursday amid talk it will protest the recent rise in eurozone yields and perhaps mull ways to restrain further increases.

The diverging trajectory on yields boosted the dollar on the euro, which fell away to a three-month low of $1.1892 and was last pinned at $1.1904.

BofA analyst Athanasios Vamvakidis argued the potent mix of US stimulus, faster reopening and greater consumer firepower was a clear positive for the dollar.

“Including the current proposed stimulus package and further upside from a second-half infrastructure bill, total US fiscal support is six times greater than the EU recovery fund,” he said. “The Fed is also supportive with US money supply growing two times faster than the Eurozone.”

The dollar index – a gauge of the US currency against a basket of other top global currencies – duly shot up to levels not seen since late November and was last at 92.057, well above its recent trough of 89.677.

It also gained on the low-yielding yen, reaching a nine-month high of 108.63, and was last changing hands at 108.41.

The jump in yields has weighed on gold, which offers no fixed return, and left it at $1,705 an ounce and just above a nine-month low.

Oil prices were up the highest levels in more than a year after Yemen’s Houthi forces fired drones and missiles at the heart of Saudi Arabia’s oil industry on Sunday, raising concerns about production. The Saudi facilities did not suffer any significant damage.

Prices had already been supported by a decision by OPEC and its allies not to increase supply in April.

Brent climbed $1.44 a barrel to $70.80, while US crude rose $1.36 to $67.45 per barrel.