Jack Ma’s Ant Group to be revamped amid China regulatory push

The overhaul will transform Ant into a financial holding company and its payments app will be opened up to competitors.

Jack Ma’s Ant Group Co. will drastically revamp its business, bowing to demands from Chinese authorities that want to rein in the country’s fast-growing Internet giants.

Ant will now effectively be supervised more like a bank, a move with far-reaching implications for its growth and ability to press ahead with a landmark initial public offering that the government abruptly delayed late last year.

Keep reading

list of 4 itemsAnt Group IPO cancellation leaves Hong Kong stocks fluctuating

Ant Group CEO Simon Hu said to resign

Ma’s wealth soars $2.3bn after China imposes milder Alibaba fine

The overhaul outlined by regulators and the company on Monday will see Ant transform itself into a financial holding company, with authorities directing the firm to open its payments app to competitors, increase oversight of how that business fuels it crucial consumer lending operations, and ramp up data protections. It will also need to cut the outstanding value of its money-market fund Yu’ebao.

The directives come as China’s regulators pledge to curb the “reckless” push of technology firms into finance and crack down on monopolies online. The twin pillars of Ma’s empire — Ant and e-commerce giant Alibaba Group Holding Ltd. — have been at the center of the increased scrutiny, sending a message to the country’s largest corporations and their leaders to fall in line with Beijing’s priorities.

Several government agencies, including the People’s Bank of China, and regulators overseeing the banking and securities sectors met with Ant to dictate the changes. The company will plan its growth “within the national strategic context,” and make sure that it shoulders more social responsibility, Ant said in its statement.

Regulators have also slapped a record $2.8 billion fine on Alibaba this month after an anti-trust probe found the e-commerce company abused its market dominance.

“The darkest hour for Alibaba has passed, but I wouldn’t say so for Ant Group,” said Dong Ximiao, chief researcher at Zhongguancun Internet Finance Institute. “The latest announcement clarified the framework for Ant’s restructuring, but the tone is still harsh and some of the requirements are tougher than expected. I don’t think the overhang is removed for Ant investors at this stage.”

While the revamp leaves Ant’s main businesses intact, regulators are making it harder for the firm to exploit synergies that allowed it to direct traffic from its payments service Alipay — which has a billion users — to other financial services including wealth management, consumer lending and even on-demand neighborhood services and delivery.

Authorities now require Ant to cut off any improper linking of payments with other financial products including its Jiebei and Huabei lending services. Ant said it will fold those units into its consumer finance arm, apply for a license for personal credit reporting, and improve consumer data protection.

Ant could add more credit borrowing options on Alipay instead of setting Huabei as the default or preferred option, Thomas Chong, a Hong Kong-based analyst with Jefferies Financial Group Inc., wrote in a report, adding that synergies between Huabei and Yu’ebao could be affected.

“Ant’s growth prospects just became a lot more challenging, given it will be much more difficult to capitalize on its scale,” said Mark Tanner, founder of Shanghai-based consultant China Skinny. “These growth challenges, in addition to the wider concerns about the tech sector regulators, makes their IPO value and attractiveness a shadow of what it was.”

Ant Chairman Eric Jing promised staff last month that the company would eventually go public. Bloomberg Intelligence analyst Francis Chan has estimated the firm’s valuation may drop about 60% from the $280 billion it was pegged at last year given the rule changes being contemplated in areas including payments.

Payments Focus

Changes to the payments business were among the top priorities regulators outlined, with Ant pledging to return the business “to its origin” by focusing on micro-payments and convenience for users.

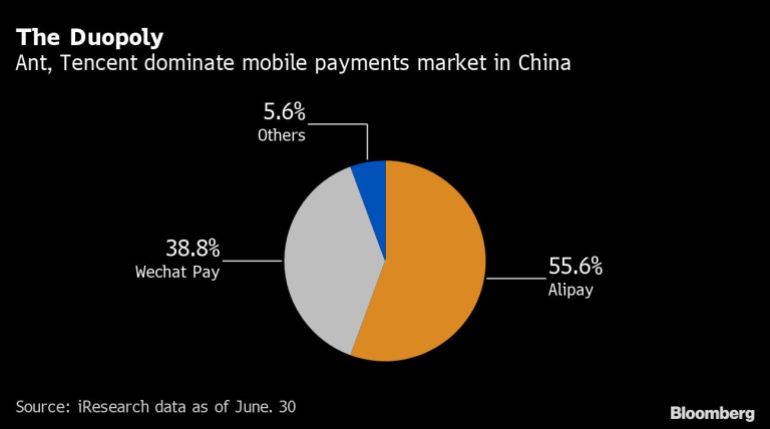

Earlier this year, China proposed measures to curb market concentration in online payments, which Ant and rival Tencent Holdings Ltd. have transformed with their ubiquitous mobile apps that are used by a combined 1 billion people.

The central bank said in draft rules that any non-bank payment company with half of the market in online transactions or two entities with a combined two-thirds share could be subject to antitrust probes.

If a monopoly is confirmed, the central bank can suggest that cabinet impose restrictive measures including breaking up the entity by its business type.

Mobile payments are only part of what contribute to online transactions, but they have become the most important platform in China, fueling growth in other services.

Investors are also awaiting final rules aimed at curbing online consumer lending, which were unveiled late last year.

Given all the changes still down the track, an Ant IPO remains “far, far away,” said Zhongguancun Internet Finance Institute’s Dong.

“The PBOC statement emphasizes risks and correction, while Ant Group’s statement sounds positive to investors,” Shujin Chen, the Hong Kong-based head of financial research at Jefferies, wrote in a report. “Ant will be the first financial holding company in China, a milestone in fintech regulation. Ant sees a clearer roadmap to restructure, although some details remain unclear.”