Asian shares recover following talks between Russia and Ukraine

Oil prices continue to climb amid persistent supply disruption fears following the invasion of Ukraine.

Asian stocks regained ground on Tuesday as investors paused to take stock of the conflict in Ukraine following inconclusive talks between Moscow and Kyiv, while oil prices continued to climb amid persistent supply disruption fears.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.42 percent, while Japan’s Nikkei jumped 1.47 percent.

Keep reading

list of 4 itemsInvestors seeking to offload Russian assets have a tough task

How are photographers highlighting the climate emergency?

Hong Kong’s leader urges calm as lockdown fears spur panic buying

Australia’s S&P/ASX 200 index gained 0.92 percent, paring earlier gains, as the country’s central bank opted to keep interest rates at a record low.

The Reserve Bank of Australia highlighted the crisis in Ukraine as a “source of uncertainty” that called for “highly supportive monetary conditions”.

Malaysia’s bourse dipped slightly, following several days of sharp gains.

“Asian equity markets have rebounded after the sharp fall in the past few trading days, but this does not mean investors are back to risk-on mode,” Gary Ng, a senior economist at Natixis in Hong Kong, told Al Jazeera.

“The dollar index and gold price are still elevated, meaning the demand for safe havens is still obvious. The first round of talks between Ukraine and Russia do not offer any significant escalation with ongoing bombing activities, meaning the risks of more sanctions will prevail and commodity prices can climb further.”

Jeffrey Halley, senior market analyst for the Asia Pacific at OANDA, said that markets may believe the “worst of the bad news is now out there, especially on the sanctions front”.

“It is equally likely though, we see another panicked rush for the door is a stream of negative headlines, a breakdown in Ukraine-Russia talks for example, or widespread use by Russia of thermobaric explosives, starts hitting the wires,” Halley said in a note on Tuesday.

Global stocks rout

Global stock markets have plunged in recent days following Russian President Vladimir Putin’s military assault on Ukraine and a Western-led sanctions campaign that has cut off some Russian banks from the SWIFT payments system, restricted Russian flights and state media, and blocked the country’s central bank from deploying its $630bn in foreign reserves.

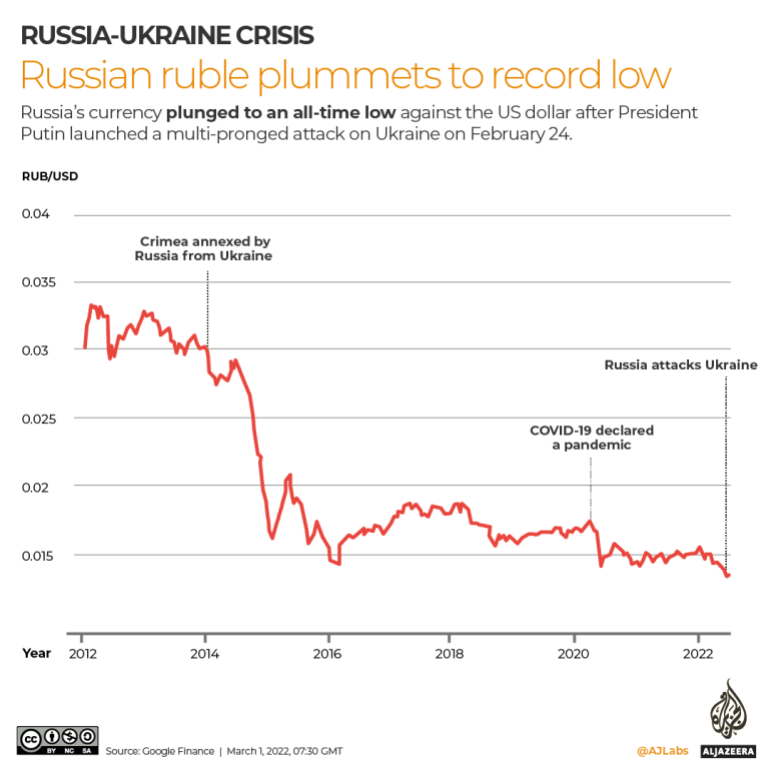

The Russian rouble crashed to an all-time low on Monday, though later clawed back some losses to reach 101 per dollar.

Energy prices have also risen amid fears of disruption to Russia’s production of natural gas and oil, the second and third-largest sources of global supply.

Brent crude futures on Tuesday rose 0.91 percent to $98.86 per barrel. The benchmark touched a seven-year high of $105.79 last week, though markets calmed as the United States and allies proposed a coordinated release of crude stocks.

Natixis’ Ng said higher oil prices would continue to fuel inflationary pressure in Asia.

“And the pressure may not only come from energy, but also in semiconductors, shipping and food if there are more disruptions,” he said.

Carlos Casanova, senior economist for Asia at UBP in Hong Kong, said it remained too early to say whether Asian markets had priced in the worst of the crisis.

“Chinese banks have moved to ban financing of Russian commodities and numerous Asian economies also followed suit by blocking exports of semiconductors,” Casanova told Al Jazeera. “This is not good news for Russia, highlighting the great economic costs of revisionist geopolitical decisions.”