Oil has wildest week on record as Ukraine crisis roils markets

Oil prices have swung within a $20 range as Russia’s invasion continues to fuel fears of a supply crunch.

Oil resumed climbing at the end of a week where prices have swung within a $20 range since Russia’s invasion of Ukraine roiled global markets and fueled fears of a supply crunch.

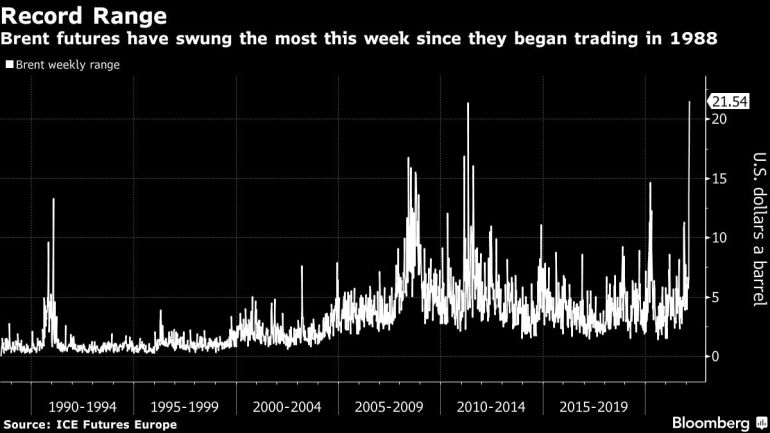

Futures in New York rose as much as 5.7% on Friday, en route to a weekly gain of over 20%. Brent has traded in its biggest range since the launch of the futures contract in 1988 — eclipsing the wild swings in the global financial crisis of 2008 and when demand plunged in the coronavirus pandemic. The rally only briefly paused Thursday as diplomats signaled negotiations with Iran were nearing some sort of resolution that could pave the way for a lifting of oil sanctions.

Keep reading

list of 4 itemsHow high will oil prices go?

Oil marches higher with sights on $114 a barrel

Western companies in Russia’s oil and gas sector

“There has been nothing to take the edge out of this market and we’ve had single direction volatility, meaning prices higher,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. To lower prices, the market would need to see a change either OPEC or U.S. drilling activity change meaningfully, he said.

Prices climbed Friday after Ukrainian officials said Russian forces attacked a nuclear plant — Europe’s biggest. While the likelihood of a major disruption to Russian supply has boosted prices this week, signs that an Iranian nuclear deal may be near have added to price volatility.

The International Energy Agency warned that global energy security was under threat, and a planned release of emergency oil reserves by the U.S. and other major economies has so far failed to quell supply concerns. JPMorgan Chase & Co. said global benchmark Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, and some hedge funds are eyeing $200.

The International Energy Agency warned that global energy security was under threat, and a planned release of emergency oil reserves by the U.S. and other major economies has so far failed to quell supply concerns. JPMorgan Chase & Co. said global benchmark Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, and some hedge funds are eyeing $200.

The invasion has reverberated throughout the energy sector. Global oil majors such as BP Plc, Shell Plc and Exxon Mobil Corp. are exiting Russia, buyers of its crude are seeking alternatives and shipping costs are spiking. Russia’s Lukoil PJSC called for a “fast resolution of the military conflict.”

While sanctions haven’t been imposed on Russian energy exports, buyers are shunning the nation’s crude as they navigate financial penalties. Germany and the White House oppose a ban on Russian oil imports, though U.S. lawmaker support to prohibit shipments into America is growing.

Prices

- West Texas Intermediate for April delivery gained $4.37 to $112.04 a barrel at 11:29 a.m. in New York.

- Brent for May settlement rose $4.11 to $114.62 a barrel.

The head of the world’s atomic watchdog said his trip to Tehran on Saturday could “pave the way” for reviving the Iran nuclear deal, a pact that would see the return of official oil exports. The OPEC producer has millions of barrels of oil stored offshore that could flow quickly into a tight market.

Brent remains in deep backwardation, a bullish structure where prompt barrels are more expensive than later-dated cargoes, signaling a tight supply-demand balance. The benchmark’s prompt spread was $3.97 a barrel after touching record levels in recent days.

Against this backdrop, OPEC+ stuck with its gradual scheduled increase of supply in April during its monthly meeting Wednesday, wrapping up the gathering in record time without discussing the invasion of Ukraine. Russia is one of the key leaders of the cartel, along with Saudi Arabia. IEA Executive Director Fatih Birol said earlier this week that the outcome of the meeting was “disappointing.”