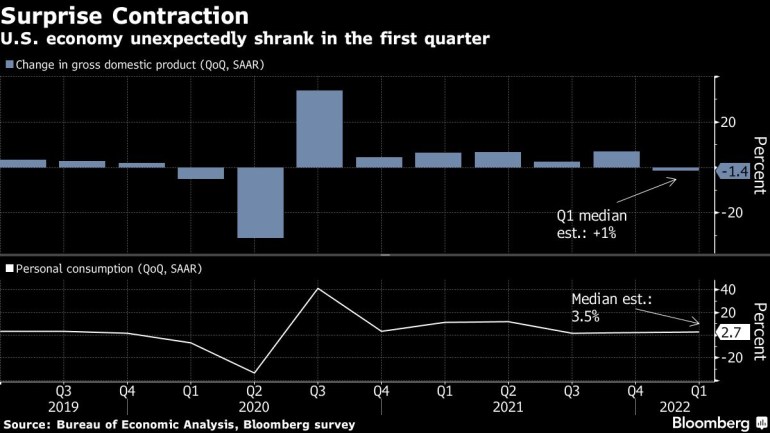

US economy unexpectedly shrinks in 2022’s first quarter

Gross domestic product fell at a 1.4 percent annualized rate.

The U.S. economy unexpectedly shrank last quarter for the first time since 2020 as the trade deficit ballooned, adding to political headaches for President Joe Biden but unlikely to sway the Federal Reserve from hiking interest rates aggressively to combat inflation.

Gross domestic product fell at a 1.4% annualized rate as surging imports and softer inventory growth more than offset otherwise solid consumer and business demand, the Commerce Department’s preliminary estimate showed Thursday. The print was below all but one estimate in a Bloomberg survey. The median projection was for a 1% increase.

Keep reading

list of 4 itemsThe Nigerian entrepreneur who runs ‘an Amazon for blood’

Meta soars as Facebook reports stronger daily user growth

Trump-tied SPAC roars back as Truth Social tops app store

Follow the reaction in real time here on Bloomberg’s TOPLive blog

Together, net exports and inventories subtracted about 4 percentage points from headline growth. Government spending shrank, also weighing on GDP.

Still, real final sales to domestic purchasers, a measure of underlying demand that strips out the trade and inventories components, increased an annualized 2.6%, an improvement from the 1.7% pace in the fourth quarter.

On its face, the headline GDP figure was decidedly soft. But underlying details show still-solid household demand and business investment, corroborating comments about the economy from company executives during the current string of earnings calls.

Against a backdrop of quicker inflation, the figures will likely keep Federal Reserve monetary policy geared for a half-point hike in interest rates next week. Nonetheless, Fed officials need to balance that policy tightening with risks associated with building price pressures.

Ten-year Treasury yields reversed an earlier decline, while stock futures and the dollar held onto gains.

“The economy is not falling into recession,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note. “Net trade has been hammered by a surge in imports, especially of consumer goods, as wholesalers and retailers have sought to rebuild inventory.”

“This cannot persist much longer, and imports in due course will drop outright,” said Shepherdson, who projected a 2% decline in GDP.

Consumer Spending

The Commerce Department’s data showed personal consumption, the biggest part of the economy, rose an annualized 2.7% in the first quarter, compared with 2.5% at the end of 2021. Services spending added 1.86 percentage points to GDP, while goods spending stagnated, reflecting changing consumer behavior.

At the start of this year, spending surged as Covid-19 cases declined. As the quarter dragged on, high inflation began to take a bite out of purchasing power. Nonetheless, many corporate executives on recent earnings calls touted the durability of the American consumer.

Looking forward, rapid inflation and dwindling fiscal support point to more moderate growth in outlays for the remainder of the year. Furthermore, higher interest rates may at some point prompt companies to trim capital expenditures budgets.

Other potential headwinds for the U.S. economy include knock-on effects from Russia’s war in Ukraine that include deteriorating growth prospects in Europe, raw-materials shortages and persistent supply-chain hiccups. Trade flows are also at risk from the Chinese government’s severe pandemic-related lockdown measures that have stymied activity at some of the nation’s ports.

How Executives See It

“We remain very confident that the fundamental strength of consumer demand trends will remain intact over multiple years.” — Whirlpool Corp. CFO James Peters, April 26 earnings call

“If anything, discretionary spending, especially from affluent consumers and credit cardholders, has been going up quite healthily. So in general, there isn’t any evident impact on inflation.” — Visa Inc. CFO Vasant Prabhu, April 26 earnings call

“North American dealer inventory remains at record lows with healthy demand further constrained by the persistent global supply chain headwinds, limiting any improvement inventory levels,” — Polaris Inc. CEO Michael Speetzen, April 26 earnings call

“While the current environment remains difficult to predict, I expect that as 2022 progresses, we will begin to experience an easing supply chain disruptions, general inventory rebuilding across many end-use markets and still a healthy consumer willing to spend, especially in North America.” — PPG Industries Inc. CEO Michael McGarry, April 22 earnings call

Last quarter, inflation-adjusted business investment increased an annualized 9.2%, the firmest in a year and reflecting stronger equipment spending and intellectual property, according to the GDP report.

Residential investment rose at a 2.1% pace, as builders began making some headway on backlogged projects. While underlying housing demand remains strong, a rapid rise in mortgage rates and record-high home prices are weighing on affordability and could begin weighing on homebuilding later this year.

The report showed trade subtracted 3.2 percentage points from GDP in the first quarter, reflecting a surge in imports and a drop in exports. The U.S. economy has recovered more quickly from than pandemic than many countries abroad, bolstering demand for foreign-made goods.

The change in inventories subtracted 0.84 percentage point from the headline figure during the January-March period. In the fourth quarter, they added a whopping 5.3 points. Looking ahead, businesses will continue to replenish their inventories in an effort to restock following the robust merchandise demand seen in 2021.

The personal consumption expenditures price index excluding food and energy, an inflation measure followed closely by Fed officials, grew an annualized 5.2% last quarter. Monthly PCE data for April will be released on Friday.

A separate report Thursday showed applications for state unemployment insurance fell slightly last week, consistent with an extremely tight labor market.

(Adds economist’s comment)

–With assistance from Reade Pickert, Kristy Scheuble and Ana Monteiro.