Indian economic growth at one year low on inflation, Ukraine war

The economy’s near-term prospects have darkened due to spike in retail inflation, which hit an eight-year high in April.

India’s economic growth slowed to the lowest in a year in the first three months of 2022, hit by weakening consumer demand amid soaring prices that could make the central bank’s task of taming inflation without harming growth more difficult.

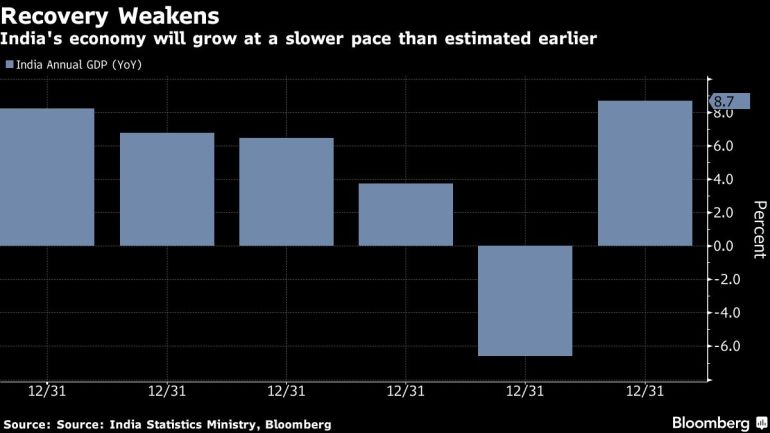

Gross domestic product grew 4.1 percent year-on-year in January-March, government data released on Tuesday showed, in line with a 4 percent forecast by economists in a Reuters poll, and below 5.4 percent growth in Oct-December and growth of 8.4 percent in July-Sept.

Keep reading

list of 4 itemsIndian rupee hits new low, stocks tumble on inflation woes

Can renewable energy help close power gap in India’s hot summer?

India’s heatwave exposes divide in access to cooling equipment

The economy’s near-term prospects have darkened due to a spike in retail inflation, which hit an eight-year high of 7.8 percent in April. The surge in energy and commodity prices caused partly by the Ukraine crisis is also squeezing economic activity.

“Inflation pressures will remain elevated,” V Anantha Nageswaran, chief economic adviser at the finance ministry, said after the data release, adding that the risk of stagflation – a combination of slow growth and high inflation – was low in India.

Rising energy and food prices have hammered consumer spending, the economy’s main driver, which slowed to 1.8 percent in the Jan-March period from a year earlier, against an upwardly revised growth figure of 7.4 percent in the previous quarter, Tuesday’s data showed.

Garima Kapoor, an economist at Elara Capital, said a slowdown in global growth, elevated energy prices, a cycle of rising interest rates and a tightening of financial conditions would all be key headwinds.

She revised her annual economic growth forecast for the current fiscal year that started on April 1 to 7.5 percent from an earlier estimate of 7.8 percent.

India’s government revised its annual gross domestic product estimates for the fiscal year that ended on March 31, predicting 8.7 percent growth, lower than its earlier estimate of 8.9 percent.

The Reserve Bank of India (RBI) this month raised the benchmark repo rate by 40 basis points in an unscheduled meeting, and its Monetary Policy Committee has signalled it will front-load more rate hikes to tame prices.

Economists expect the MPC to increase the repo rate by 25-40 basis points next month.

Weakening demand

Economists said the weakening consumer demand and contraction in manufacturing activities were a concern.

High-frequency indicators showed supply shortages and higher input prices were weighing on output in the mining, construction, and manufacturing sectors — even as credit growth picks up and states spend more.

Manufacturing output contracted 0.2 percent year-on-year in the three months ending in March, compared with an expansion of 0.3 percent in the previous quarter, while farm output growth accelerated to 4.1 percent from 2.5 percent expansion in the previous quarter, data showed.

The rupee’s more than 4 percent depreciation against the US dollar this year has also made imported items costlier, prompting the federal government to restrict wheat and sugar exports and cut fuel taxes, joining the RBI in the battle against inflation.

“With rising inflationary pressures, the consumption recovery remains under a cloud of uncertainty for 2022-2023,” said Sakshi Gupta, principal economist at HDFC Bank.