US consumer spending rises in June as inflation takes bigger bite

The personal consumption price index, which excludes the volatile food and fuel components, jumped 6.8 percent in June compared with a year earlier.

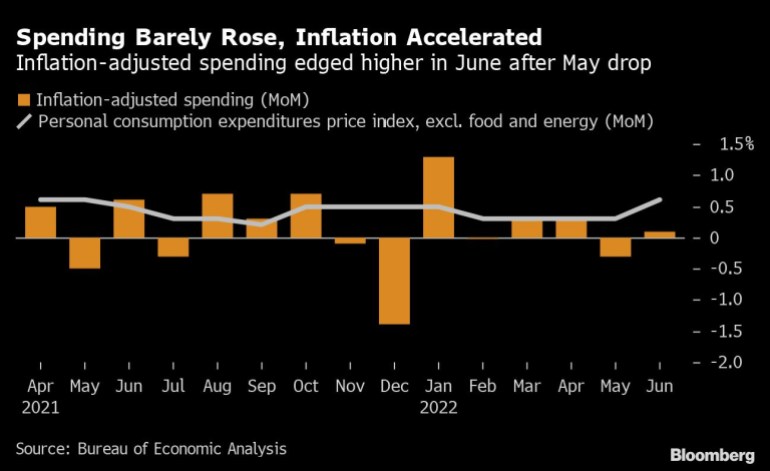

US consumer spending barely rose in June after falling in the prior month, underscoring how decades-high inflation has eroded Americans’ paychecks and tempered demand.

Purchases of goods and services, adjusted for changes in prices, increased 0.1% in June after a revised 0.3% drop a month earlier, Commerce Department data showed Friday. Spending on services and merchandise both crept higher.

Keep reading

list of 4 itemsWill the Middle East be a flashpoint between the US and China?

Fed hikes rates by 75 basis points for 2nd straight month

‘Uncharted territory’: Five key takeaways on US inflation

The personal consumption expenditures price index, which the Federal Reserve uses for its inflation target, rose 1% from a month earlier and was up 6.8% since June 2021. The annual advance was the biggest in 40 years.

Excluding food and energy, the price index increased a larger-than-forecast 0.6%. That was the biggest gain in more than a year. The core measure was up 4.8% from a year ago, a slight acceleration from the previous month.

Stock futures moved higher after briefly paring gains on inflation concerns. Treasury yields were also up slightly along with the dollar.

The figures come just a day after separate data showed the economy shrank in back-to-back quarters and underscore how spending power has deteriorated in the face of surging prices. Americans’ incomes, while growing, are still not keeping pace with rapid price increases, and that’s left many consumers with little — if any — leftover cash to spend after paying for necessities like gas, food and rent.

Lower Savings

The saving rate declined to 5.1%, the lowest since 2009, from 5.5% a month earlier, according to the report.

A recent Census Bureau survey showed four in 10 Americans say it’s somewhat or very difficult to cover usual household expenses, the highest share since the question was first asked in August 2020.

The Fed is determined to bring down inflation, and fears are mounting on whether the central bank’s actions, which have already slowed home sales, will tip the economy into a recession.

While inflation-adjusted outlays for services rose 0.1%, the gain was the smallest this year. Spending on merchandise posted a similar advance but it followed a 1.6% slump in the prior month.

Unadjusted for inflation, spending rose 1.1% from the prior month, while personal income increased 0.6% for a second month.

Businesses have already noticed changes in consumer behavior as inflation erodes workers’ discretionary incomes. McDonald’s Corp. says it’s seeing customers trade down to its value offerings, and Walmart Inc. says receipts are tilted more toward food and away from general merchandise like apparel.

And while the labor market so far continues to add jobs at a healthy pace, a slew of tech companies have announced layoffs or plans to slow hiring. Any significant broadening in such behavior across sectors would add to concerns of an imminent downturn and help shape monetary policy in the coming months.

Earlier this week, the Fed raised interest rates by another 75 basis points and policy makers said they anticipate “ongoing increases” will be appropriate. Though how much depends on how the economy performs, said Fed Chair Jerome Powell.

“Restoring price stability is just something that we have to do,” Powell said during a press conference Wednesday.

Meanwhile, a closely watched measure of wages and benefits — the employment cost index — climbed in the second quarter by more than forecast. The Labor Department’s report Friday showed a 1.3% advance, heightening concerns inflation will remain persistently high.

The consumer price index, which typically runs hotter than the PCE price index, jumped to a fresh 40-year high of 9.1% in June. Earlier this week, Powell said the PCE gauge is a better measure of inflation.

Wages and salaries increased 0.5% in June. When adjusted for inflation, however, disposable personal income dropped 0.3%, the most in three months.

(Adds graphic)

–With assistance from Kristy Scheuble.