US rollback of student loan forgiveness hits borrowers, economy

Student loan forgiveness meant borrowers had money to spend on a new home, start a new business or even start a family.

Isabella Johnson, a psychologist in Arkansas, has a lot on her plate. She helps her son, who has some pre-existing health issues, pay his debt on both a bachelor’s and master’s degree. In August 2022, President Joe Biden announced his plan to forgive some student debt. For Johnson, that meant she could move forward with other large expenses. She just bought a house two weeks ago.

A series of rulings last week by the Supreme Court striking down the Biden administration’s student loan forgiveness programme has changed her situation. After the ruling, the mortgage lender backed out because now her income-to-debt ratio – which compares how much she owes each month with how much she earns – no longer works for them.

Keep reading

list of 4 itemsAs Canada reels from wildfire, First Nations hope for larger role

Why is the giraffe facing a silent extinction?

Fears simmer for Russian reporter after brutal attack in Chechnya

Tim O’Connell of Roanoke, Virginia, also had his eyes set on a home. July 11 will be the first anniversary of his job with the United States Postal Service. He’s a Pell Grant recipient and owes $16,000— $4,000 less than the Biden administration’s proposed cap for Pell Grant recipients.

Thanks to a little help from the promised debt relief, he was able to pay off his car and almost all of his wife’s, as well. The American dream of home ownership was within arm’s reach, said O’Connell. However, the Supreme Court’s decision has pushed that milestone further down the road.

The move is a major setback for Americans like Johnson and O’Connell.

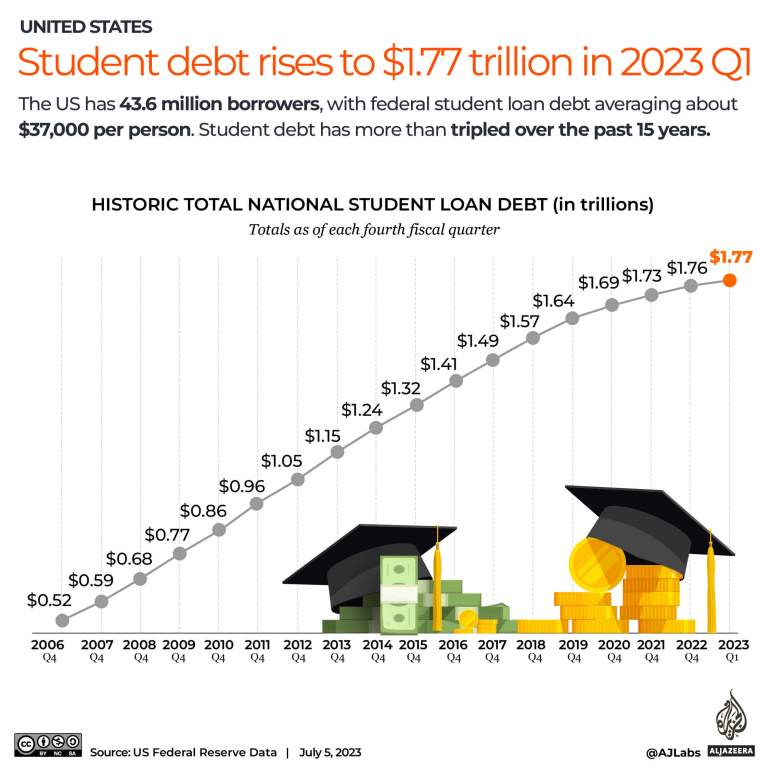

While their situations are much different, they are indicative of the ripple effects on the greater economy. With a combined $1.7 trillion owed in student debt, everything from fairytale weddings to new cars are out the window.

President Joe Biden first announced his student loan forgiveness programme in August 2022, under which a $400bn slice of federal student debt would be wiped out, helping some 20 million Americans. The effect was almost immediate as consumer spending ticked up $113bn or 0.6 percent in the month following. Housing and new car sales led the gains.

The spending increase took place despite increased interest rates imposed by the US Federal Reserve to dampen surging inflation.

Under the plan that was scrapped last week, the administration would have cancelled up to $10,000 ($20,000 if they received a Pell Grant) per borrower that earns less than $125,000 annually. The Department of Education had already approved the cancellation of student debt of 16 million applications.

The Supreme Court’s ruling move is a major win for Republicans who have pushed back on the president’s plan from the get-go.

On Friday, Biden pledged to fight the decision and announced new actions that would ensure some debt relief via The Higher Education Act. Biden also announced a one-year ramp-up for loan repayments. During that time, missed payments will not be reported to credit bureaus.

The president acknowledged, though, that getting relief may take much longer.

Improved finances

The delays have been particularly telling for consumers like Tara S of Tampa, Florida, a home buyer who requested that Al Jazeera not use her last name out of respect for her privacy.

“I graduated college in 2012; before the pause my payments were $400+ per month but I bought a house since then, and my finances are very different. I will likely need to restructure my student debt. Biden’s revised plan won’t be close to the cheapest option,” Tara S told Al Jazeera.

Many Americans opted for bigger investments that would be paid over a longer period of time despite high interest rates. In large part, the promise of student loan forgiveness meant borrowers had the money they would otherwise use to pay back their student loans.

A 2021 Brookings Institute report found that if forgiveness was on the table, consumers were more likely to buy a new home, start a new business or even start a family.

“People that have student debt tend to put those things on hold for longer periods of time in lieu, maybe saving for a down payment of a house. We weren’t really surprised,” Jason Jabbari, assistant professor at the Social Policy Institute at Washington University in St Louis, and an author of the 2021 Brookings report, told Al Jazeera.

“The student repayment pause for the first time started alleviating a lot of the financial impacts on people. They didn’t have to deal with their unaffordable, unmanageable student debt for once. And in fact, the people that had the most trouble paying off their debt and had the highest balances were those that overwhelmingly benefitted from the repayment pause,” Laura Beamer, lead researcher on higher education finance at Jain Family Institute, told Al Jazeera.

“We saw credit scores going up, mortgage rates going up, delinquencies and defaults going down, medical debt going down, medical debt and collections going down, mortgages and delinquency going down. And that happened during the repayment pause,” Beamer added.

Mounting debt

Much of that momentum will soon backtrack. Goldman Sachs has forecast that the Supreme Court’s decision would drive the Personal Consumer Expenditures Index (PCE) down by two-tenths of a percent. In other words, consumers will cut back their expenses, which means less cash flow to stimulate the economy.

There are many Americans who share Tara’s concerns. In fact, according to a recent survey from Morgan Stanley ahead of the Supreme Court decision, 37 percent of borrowers do not think “they could make regular student loan payments without … adjusting spending in other areas,” the report said while 34 percent of respondents said they will not be able to make the payments at all.

Repayment is not going to get any easier as time goes on. “Because student debt balances have the tendency to increase rather than decrease during the repayment period, which is a byproduct of unaffordable interest rates, most of this debt is never going to be repaid. It’s extremely important to deal with this issue now, rather than many years from now, because in the interim, the student debt crisis will only get worse, wreaking more havoc on the lives of student borrowers and their families,” Beamer said.

A 2021 report by the Consumer Law Center found that a third of all student loan recipients still owed more than 125 percent of their original loan amount, despite making at least some payments during the federal student loan payment pause that was introduced during the pandemic.

Tara S looked out on a similar situation: “I took out $29,000, have paid back $21,000, and still owe $22,000,” she said.