'The cancer could be quicker than saving the money'

In Lebanon, a son confronts the challenge of finding $7,000 every three weeks for his mother's cancer medication.

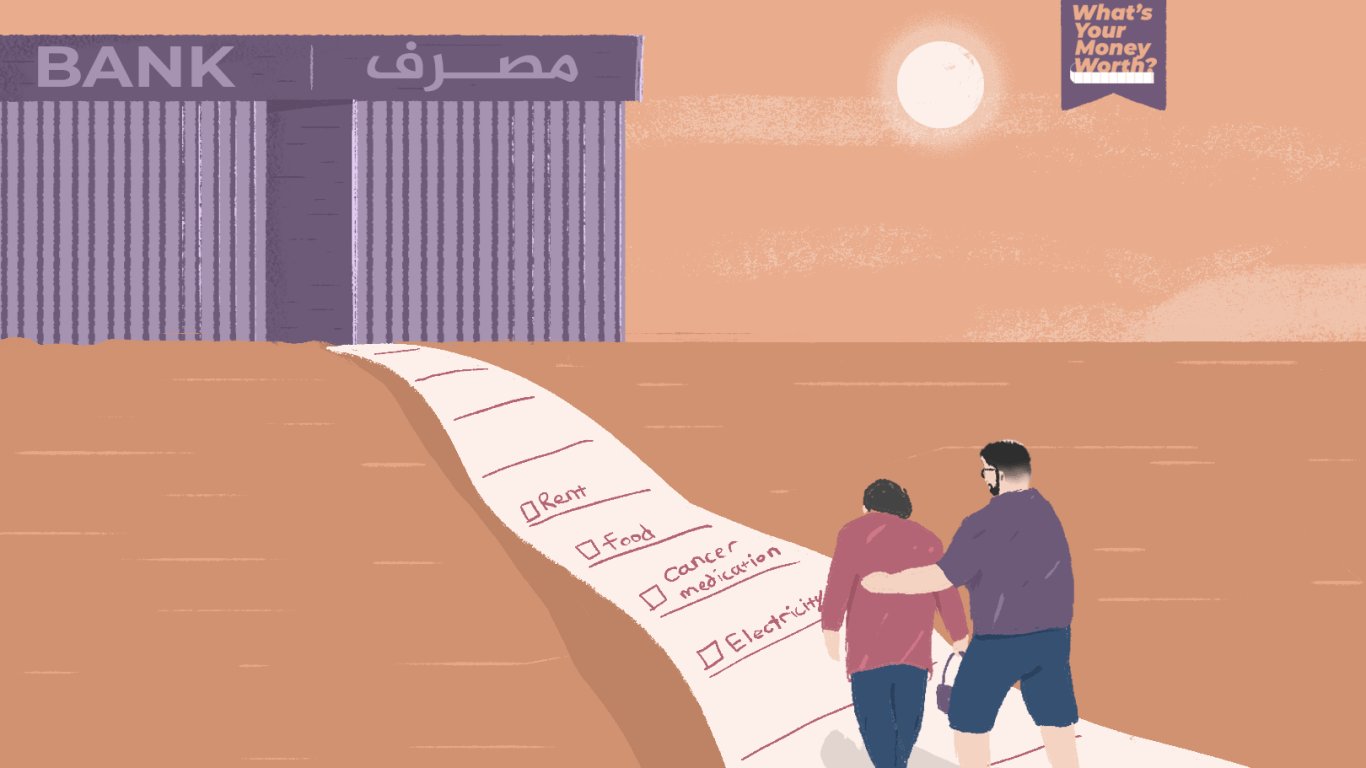

What's your money worth? A series from the front line of the cost of living crisis, where people who have been hit hard share their monthly expenses.

Name: Chadi Azar

Age: 40

Occupation: Freelance graphic designer

Lives with: A canary, a lovebird called Papaya and two finches

Lives in: A rented three-bedroom apartment in the district of Byblos, also known as Jbeil, Lebanon, one hour from the capital, Beirut. The apartment is bigger than Chadi needs but it was all that was available when he decided to move to his parents' neighbourhood after his mother was diagnosed with cancer.

Monthly household income: About $1,000 (the median monthly income for Lebanon is $122 according to Human Rights Watch). Chadi earns in both US dollars and Lebanese pounds. Both currencies are used in Lebanon.

Total expenses for the month: $969. In May, he spent about half his salary on rent, while the rest went towards medication for his mother and himself, food, transport, electricity, phone and internet. He could not afford the $3,000 cost for one dose of his mother's cancer medication, which she needs to take every three weeks.

For 10 years, freelance graphic designer Chadi Azar worked hard to save money, eventually saving $40,000 in his bank account. He planned to buy a small house with this money and hoped it would bring him some stability.

But then in 2019, after decades of corruption and mismanagement by Lebanon’s ruling elite, the country’s financial and banking systems crashed. The dollars had dried up and banks could no longer pay depositors their money, allowing only limited withdrawals in Lebanese pounds at a fraction of the original value when deposited. Chadi and millions of Lebanese were effectively locked out of their savings.

“Our government has stolen from and abandoned its people,” says Chadi, who barely touches his coffee as he sits in a cafe close to his home one afternoon in May.

The same year as the collapse, Chadi's 60-year-old mother Hala was diagnosed with breast cancer. After paying $3,500 for additional tests, they discovered the cancer was metastatic - it was spreading through her bloodstream.

It soon reached her lungs, which required her to have targeted radiation treatment, costing the family about $3,000. She responded well to the treatment but the cells are still active in her bloodstream.

So Hala must take medication to prevent the cancer from growing elsewhere.

Inaccessible medication

Chadi's home is filled with plants and the sound of wind chimes. On his computer screen are images of cosmetic bottles splashing into water; he is currently learning how to animate water drops and sometimes stays up as late as 4am teaching himself new techniques.

“The graphic design world is evolving in a fast way because of AI … every day there is new stuff to learn,” he explains.

But for Chadi, the motivation to learn and work is also driven by the need to pay for his mother’s medication.

Hala has been prescribed a specific drug. But one dose of this medicine, which is required every three weeks, costs $7,000. And even if Chadi could afford it, it is not available in Lebanon, so he would have to bring it in from overseas.

Instead, Hala had been taking another type of medication, which the government had previously subsidised for her, and still does for some cancer patients. But amid the economic crisis, it has stopped subsiding a broad range of medication - and as the one Hala was taking is not perfectly indicated for her case, she must now pay for it.

The medicine costs 290,052,960 pounds (about $3,000 according to the black market rate, which in May averaged at 100,000 pounds to the dollar**). As Chadi earns about $1,000 a month, sometimes more, sometimes less, it is impossible to afford the medication on his salary, and his family, who barely make enough to cover their own living expenses, cannot help out. This has left Chadi feeling anxious and depressed.

“I went crazy in Septembe, because I couldn’t handle not getting the medication for her any more,” Chadi explains as he sits on his balcony.

But even if he could afford it, the medication is not always available in the hospital.

“She’s skipped many doses now,” he says, solemnly.

‘She’s always positive’

Chadi’s monthly earnings allow him to afford rent, food and bills in a country where more than 80 percent of people now live below the poverty line, but he says it is not enough to keep his mother alive.

“If you make $1,000 a month, you can live your life in a decent way. But God forbid someone you love gets sick, and you have to pay $7,000 a month to keep them alive, that is psychologically damaging for you,” Chadi explains.

“When there's someone in your family that needs healthcare, and healthcare is not provided by the people [the government] who should provide this, it would be a disaster for anyone,” he adds. “The government should pay that money.”

The only thing that keeps Chadi’s anxiety at bay is working.

Chadi can see his parents' home from his balcony. His father Sabah used to be a fisherman and, with its figurines of anchors and jars of seashells, their home is an ode to the nearby sea. Hala shares her 63-year-old husband's love of the water, but her condition makes swimming difficult these days.

Still, Chadi says, his mother's faith keeps her strong. But, for him, only getting the medication she needs will make him feel better.

‘She’ll feel so sad’

Hala cleans the church near her house most days of the week. It is voluntary work. But on days when there are weddings, she receives about $60 for her services. Sabah earns $200 a month working seven days a week as a night security guard at a furniture store.

“I make sure he keeps his money aside and saves it so he feels safe or can use it if something happens,” Chadi explains.

At the start of the economic collapse in 2019, Chadi says no one believed the economy would ever get this bad.

But the pound hit 130,000 to the dollar at the start of May this year. Just a year earlier, it had stood at between 26,850 and 35,690 pounds to the dollar, and that was already a massive depreciation from the 1,500 pounds to the dollar before the collapse.

Some Lebanese have taken matters into their own hands, entering banks with weapons and demanding the tellers hand over their savings. Chadi says he understands such actions.

“When they [people] get hurt so much in their life and there are so many unfair things, you can lose your mind and you can do anything,” he reflects.

“But I’m not able to take a gun and go get my money, because I calculate things, what if I end up in prison … What if no one stood up for me?” he asks. "Then I’m going to make more drama for my mum … she’ll feel so sad.”

Over the course of a month, from May 1 to May 28, 2023, as part of a collaborative project, Chadi Azar tracked his expenses with reporter Tessa Fox.

Here are the expenses that tested his finances the most.

Expenses over one month

Cancer medication

After paying for his living costs and supporting his parents, Chadi is sometimes only able to put about $100 or $200 towards Hala’s cancer medication each month.

“The cancer could be quicker than saving the money,” he says, glumly.

Chadi has been researching how to import the medicine for cheaper from Turkey, but he is concerned about counterfeit products.

While Chadi was able to find a box of Hala's medication in April through a helpful doctor and paid for it from his savings, when his mother was due to take it again on May 24, he did not have the money for it.

“Her doctor says, if you give her … [the medication irregularly], it might not be effective,” Chadi says, concerned.

“Her tumours shrank when she was taking this medicine regularly,” he explains. “It was a crime the government stopped paying and delivering.”

Earlier this year, Chadi launched a crowdfunding campaign aiming for $140,000 to pay for 20 doses of the medicine that is indicated for Hala's case. This amount would last about a year and a half.

“I feel that my mum is a little bit ashamed of asking people for money or medication. But for me, there's no other way,” Chadi says defiantly. “I’m calling for help before the ship sinks, as you say. We need to get my mother the medicine.”

May 2022: Free (subsidised by the government)*

May 2023: $3,000 for one dose

Rent

After Hala was diagnosed, Chadi, who used to live 40 minutes away, moved into the same street as his parents so that he could help out and provide emotional support.

His apartment is serene and has plants and his paintings on the walls. “I love plants. I brought this monstera home from a cutting off the road,” he says as he points to a large plant on the balcony with a view of the sea, about a 10-minute drive away.

Chadi pays a monthly rent of $400. Although he says it is stressful that nearly half of his income goes towards rent, the cost is worth it as he is close to his parents and he otherwise lives simply. Aside from not being able to afford his mother’s medication, he believes he is economically fortunate in a country where 40 percent of households earn approximately $100 or less per month.

May 2022: $400 (12 million pounds according to the black market rate at the time which averaged 30,000 pounds to the dollar)*

May 2023: $400 (40 million pounds)

Food

Since the economic crisis took hold in 2019, food prices have fluctuated almost daily due to the volatile pound-to-dollar rate. For shopkeepers to maintain stable prices, the government decided in February to dollarise most food items. This stabilised the price of essentials. But customers paying in pounds - like Chadi and most people in Lebanon - pay according to the day's black market rate.

Food inflation remains high. It hovered at 113 percent at the end of April 2023, according to the World Bank. It had reached 460 percent in January 2022.

Even with the high cost of food, Chadi will not allow himself or his parents to eat unhealthy meals.

“I don't, for example, resort to canned food, because it's going to be more expensive on our health further down the track. I try to think about the healthier way to live,” he explains.

Chadi's father often buys the least expensive product, like margarine instead of butter. “I tell him not to buy it and then I replace it, because margarine is full of cholesterol and hydrogenated oils,” Chadi says.

Even if he eats healthily, food is never an indulgence for Chadi. "The luxury I want in my life is to be able to sleep and think my mum is OK.”

Chadi and his parents share their meals, alternating the days they cook and Chadi makes sure to always keep their fridge stocked.

May 2022: 9 million pounds ($300) for groceries for the family*

May 2023: 30 million pounds ($300)

Medicine for Chadi’s migraines

Chadi started getting intense, daily migraines after his mother’s diagnosis and he has to take medication each day just to function.

May 2022: 1.5 million pounds for migraine medication ($50)*

May 2023: 5 million pounds for migraine medication ($50)

*Last year's figures sourced from Chadi.

**All conversions are according to the black market rate, which is the rate used to calculate purchases in Lebanon.

Six quick questions for Chadi:

1. What's one thing you had to forgo this month? My mother's cancer medication.

2. Which is the most worthwhile expense from this month? Food for mum.

3. When finances get tough - what advice do you have? My advice to people is to leave this country before it is too late and the situation of their parents becomes like mine.

4. What’s your biggest money worry? Cancer treatments.

5. What’s the saving hack you are proudest of? Working hard is my saviour.

Read more stories from the series: What's your money worth?