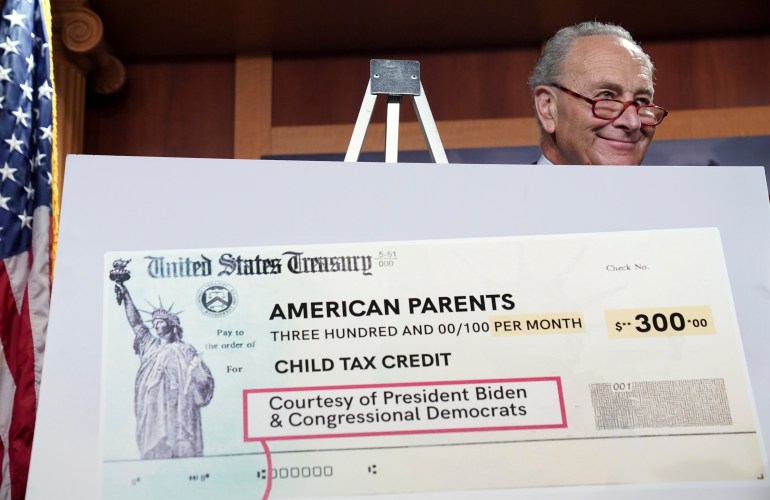

Biden says child tax credit a ‘giant step’ to counter poverty

The Child Tax Credit is being likened to a universal basic income for children that helps people meet monthly expenses.

Some 35 million American families have started receiving their first monthly payout from the US government in an expanded income-support programme that President Joe Biden said on Thursday could help end child poverty.

Under the Child Tax Credit programme that was broadened under Biden’s COVID-19 stimulus, eligible families collect an initial monthly payment of up to $300 for each child under six years old and up to $250 for each older child.

Keep reading

list of 3 itemsBiden urges Putin to act on ransomware attacks, hints retaliation

Amid crime spike in US, Biden meets police chiefs

Payouts made to families, covering nearly 60 million eligible children, totalled about $15bn for July. The payments are automatic for many US taxpayers, while others need to sign up.

Biden wants to extend expanded, monthly benefits for years to come as part of a $3.5 trillion spending plan being considered by Senate Democrats, who expect strong Republican opposition to the full bill.

“It’s our effort to make another giant step towards ending child poverty in America,” Biden said in a speech. “This can be life-changing for so many families.”

The Child Tax Credit is being likened to a universal basic income for children, although it has income limits. It is expected to help people meet monthly expenses from rent to food and daycare.

The Center on Poverty and Social Policy at Columbia University estimated the expansion can reduce the US child poverty rate by up to 45 percent.

Critics have said the expanded credit is expensive and may discourage people from working. Some experts said it may not reach some of the poorest Americans who are not in the tax system.

The Democrat-backed $1.9 trillion COVID-19 legislation known as the American Rescue Plan enacted in March increased how much is paid to families under the programme.

The law made half of the tax credit for the 2021 tax year payable in advance by the Internal Revenue Service in monthly installments from July through December this year.

Biden proposed making the monthly advance payments permanent and maintaining expanded benefits through 2025 at least.

Florida Republican Senator Marco Rubio, who successfully championed increasing the credit in 2017, said that the Democrats’ plans will turn the benefits into an “anti-work welfare check” because almost every family can now qualify for the payment regardless of whether the parents have a job.

“Not only does Biden’s plan abandon incentives for marriage and requirements for work, but it will also destroy the child-support enforcement system as we know it by sending cash payments to single parents without ensuring child-support orders are established,” Rubio said in a statement Wednesday.

The administration disputed those claims. Treasury Department estimates indicate that 97 percent of recipients of the tax credit have wages or self-employment income, while the other 3 percent are grandparents or have health issues. The credit also starts to phase out at $150,000 for joint filers, so there is no disincentive for the poor to work because a job would just give them more income.

Colorado Democratic Senator Michael Bennet said the problem is one of inequality. He said that economic growth has benefitted the top 10 percent of earners in recent decades, while families are struggling with the rising costs of housing, child care and healthcare. He said his voters back in Colorado are concerned that their children will be poorer than previous generations and that required the expansion of the child tax credit.

“It’s the most progressive change to America’s tax code ever,” Bennet told reporters.