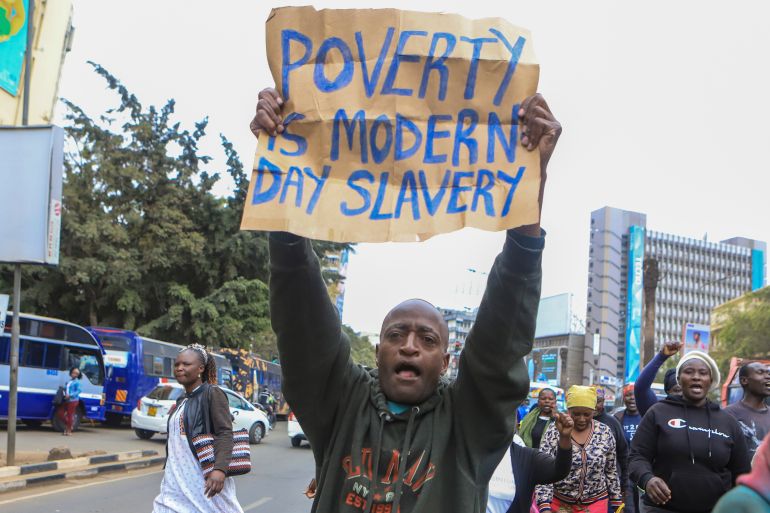

Calls to tax the superrich grow as economic inequality surges

Billionaires have seen their wealth expand by 109 percent over the past decade from $5.6 trillion to $11.8 trillion as their fortunes increase $2.7bn a day.

Economists and many millionaires are calling on governments to impose taxes on the world’s superrich, warning of an unfolding “economic, ecological and human rights disaster” caused by escalating wealth inequality.

The demand was made by more than 300 people in an open letter ahead of a summit of the Group of 20 (G20) richest countries in India from Saturday to Monday.

Keep reading

list of 4 itemsIMF warns UK its budget cuts will ‘likely increase inequality’

As Cuba’s private sector roars back, choices and inequality rise

Fentanyl: The new face of the US war on the poor

“Skyrocketing wealth accumulation by the few is threatening political stability all over the world,” millionaires, politicians and economists said in the letter to those who will meet in New Delhi.

Billionaires have seen their wealth grow by 109 percent over the past decade – from $5.6 trillion to $11.8 trillion in total, according to Oxfam International, which focuses on the global alleviation of poverty. Their fortunes grow a collective $2.7bn a day, it calculated.

The top 10 percent of the planet’s richest individuals own 76 percent of the world’s wealth while the bottom 50 percent of the global population possesses just 2 percent, according to the 2022 World Inequality Report.

“Such steep levels of inequality undermine the strength of virtually every one of our global systems and must be addressed head-on,” the signatories of the letter to G20 leaders wrote.

Government policies around the world have greatly benefitted the wealthy and the finance sector while failing to protect working-class interests, critics said.

Taxing the ultrarich by 5 percent could raise $1.7 trillion a year, enough to bring two billion people out of poverty, according to a report by Oxfam.

Even a tax rate of 3 to 4 percent would generate significant revenues because wealth concentration is so extreme and has grown so dramatically in the past few years, said economist Jayati Ghosh, a signatory of the Tax Extreme Wealth letter.

“In India, for example, a 4 percent tax on dollar billionaires [less than 1,000 families] would generate revenues of 1 percent of GDP – as much as total public health spending by central and state governments taken together,” Ghosh told Al Jazeera.

The main obstacle to the implementation of a global tax system for the mega-rich, however, is “political, of course”, she said.

Economic charter of rights

Frank Stronach – the founder of Magna International Inc, a multibillion-dollar company operating in 29 countries – has developed a unique “corporate constitution” that shares profits among employees.

Stronach, writing in Canada’s National Post newspaper, also proposed nations create an “economic charter of rights” to tackle the deepening problem of wealth inequality.

“With an economic charter of rights, companies with more than 300 employees would be required to share 20 percent of their annual profits with employees,” Stronach said.

“A country adopting an economic charter would create a much fairer and broader-based distribution of wealth than any system that has previously existed … The extreme concentration of wealth in the hands of a few inevitably leads to economic domination. We need to break those chains.”