Unease over COVID, Fed tapering and China’s economy grips markets

Markets shuddered on Thursday over rising concerns about the health of China’s economy, the Delta variant of the coronavirus and the tapering of US Federal Reserve stimulus.

Iron ore, luxury stocks and the dollar are all sending the same message across markets: investors are getting uneasy.

That anxiety was on display on Thursday as global markets shuddered in the wake of concerns stretching from China’s economy, Covid and the tapering of Federal Reserve stimulus. While the pain was sharpest in commodities and cyclicals, even defensive tech stocks slumped.

Keep reading

list of 4 itemsThe US spent $2 trillion in Afghanistan – and for what?

Will cryptocurrencies run traditional banks out of business?

Inflation fears tamp down markets despite latest US stimulus

“What if the Fed can’t taper, let alone hike? This market is wedded to the narrative,” said Kit Juckes, chief foreign-exchange strategist at Societe Generale SA in London.

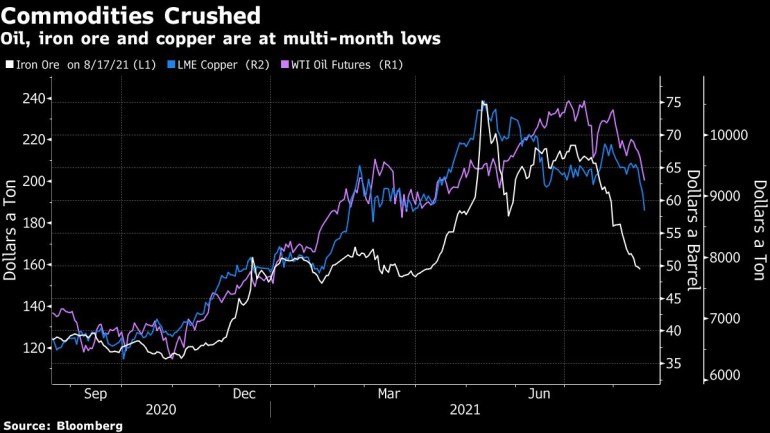

While global equity markets are still teetering near all-time highs, there’s evidence across other markets that all is not well. The clearest alarm bell is coming from commodities most sensitive to any shifts in economic growth.

Iron ore, the raw material for steel, sank to an eight-month low. Oil fell to the lowest since May and global commodity shares lost almost 2%.

Investors sought havens, pushing the dollar index to the highest since November. Gold held up in the face of pressure, with prices steady at $1,791 an ounce.

“There appears to be this wall of worry and it almost feels as if investors are looking for excuses to continue to climb this wall of worry,” said Anneka Treon, a managing director at Van Lanschot Kempen. “It appears to be an inflection point.”

Even luxury, an industry once viewed as recession-proof, looks like a pain point as Asian countries go into lockdown and China slows. France, the home of Hermes International and LVMH, led a broad selloff in European stocks. The benchmark CAC Index sank 2.6%, the most in a month.

Here’s three other examples of angst in the market:

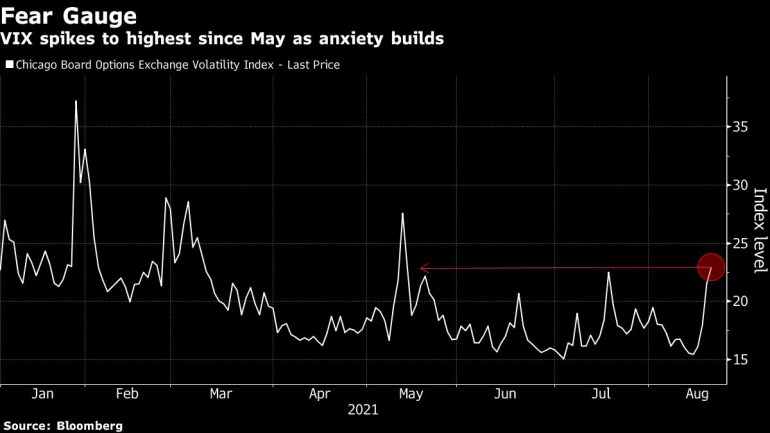

Volatility Indexes

The Cboe Volatility Index jumped above 23, the highest level since May. While August is typically a turbulent month and mid-month sell-offs have become a feature of markets all year, one-sided positioning may also be fueling the surge. Systematic volatility sellers have been out in force recently according to Credit Suisse Group AG, and any turbulence could be spurring them to cover their positions.

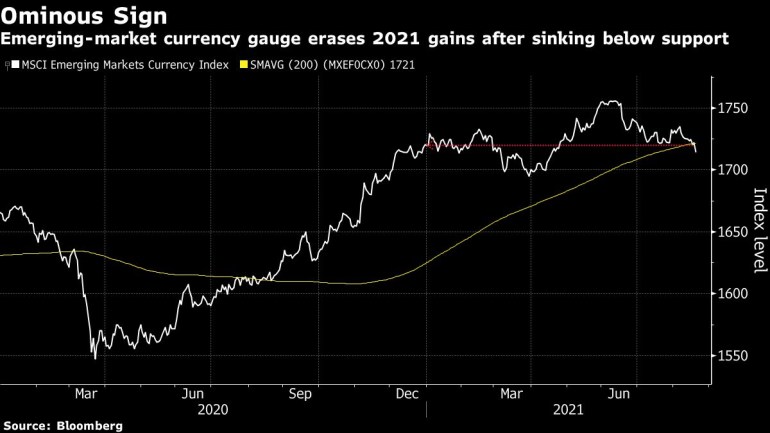

Emerging-Market Currencies

MSCI’s emerging-market currency index erased all of its gains for the year on Thursday. The index closed below its 200-day moving average this week, heralding further declines.

“Risk aversion has been rising and the U.S. dollar is on the front foot,” said Mitul Kotecha, chief emerging markets Asia & Europe strategist at TD Securities in Singapore.

Energy Stocks

West Texas Intermediate futures have fallen for six days, taking down the wider energy space in the process. Oil and gas producers in the MSCI World Index sank as much as 1.6%.